Red Flags in Amended Annual Reports - Quarterly Update #8

A quarterly review of compliance trends, SEC comment letters, and the complexities of recovery analysis

Why are amended 10-Ks important?

Businesses frequently submit revised annual 10-K reports to make technical changes, such as filing proxy information or correcting minor typos. These amendments are typically routine and hold little significance for investors.

Nevertheless, some amended reports convey adverse developments, such as uncovering inaccuracies in previously submitted financial statements or reporting deficiencies in internal controls. These revisions warrant scrutiny because the disclosed negative information may be substantial, and the amended filing could serve as the initial source for announcing such developments.

Amended 10-K filings - quarterly update # 8

In this quarterly update, I examine the reasons for the 10-K/A amendments filed between July 1, 2025, and September 30, 2025. (Quarterly update # 7 is available here.)

Companies filed 96 amended 10-K reports in the September 30, 2025 quarter - a 35% decrease compared to 147 amended 10-Ks filed during the September 30, 2024 quarter.

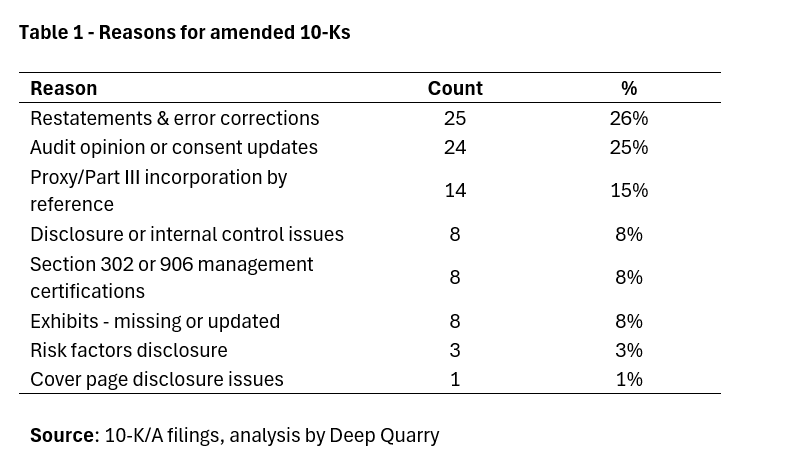

Table 1 below reflects the primary reasons for the amendments.

(Company-level data underlying quarterly 10-K/A updates is available to premium subscribers.)

The discussion of selected categories and filings is below.

Audit opinion or consent updates

In the June 30, 2025 quarter, 24 10-K/As were filed to correct or modify the information contained in audit opinions or auditors’ consents – a decrease of about 40% compared to 40 amendments filed to replace or modify audit opinions during the September 30, 2024 quarter.

The decline in the number of opinion-related 10-Ks is partially attributed to the absence of amendments related to BF Borgers, which was sanctioned by the SEC in May 2024. Companies that were previously audited by BF Borgers had to engage a new audit firm and could not include opinions issued by Borgers in the 10K filings or present quarterly financials reviewed by Borgers in the 10-Q reports after May 3, 2024 (the date of the SEC order).

Like the previous quarters, most opinion-related issues involved technical updates, such as correcting the opinion’s signature dates or city references.

Amendments related to missing audit opinions or consents

Public companies are expected to file audited annual financial statements, providing investors with confidence that these statements comply with accounting standards and fairly represent the company’s financial position. Filing financial statements without the auditor’s consent raises concerns about unresolved audit issues, potential misstatements, or failed communication between management and the auditor. (See my previous post on reports filed without an auditor’s consent.)

In the September 30, 2025 quarter, two companies amended their annual reports to file an omitted audit opinion.

PreAxia Healthcare Systems Inc. (Ticker: PAXH) filed an amended 10-K on September 30, 2025, to provide audited financial statements and an audit report for the fiscal years ending May 31, 2025, and 2024. The financial statements filed in the original 10-K for the year ended May 31, 2025, filed on EDGAR on September 12, 2025, were not audited or reviewed by PreAxia’s independent accounting firm, Fruci and Associates II, PLLC, and included the following warning:

“This filing has not been audited or reviewed by a PCAOB Registered Accounting firm. As soon as an audit for the financial statements has been completed, we will file an amendment to include the audit report.”

PreAxia disclosed a net loss of $53,687 for the year ending May 31, 2025, in its unaudited September 12, 2025, 10-K, compared to the net loss of $82,010 for the same period reported in the audited 10-K filed on September 30, 2025

Golden Growers Cooperative (Ticker: GGROU) filed an amended annual 10-K report on September 17, 2025, to include an omitted audit opinion of its previous auditor, Widmer Roel PC, for the year ending December 31, 2023. The 2023 audit was omitted from the original 10-K filing dated March 18, 2025.

Restatements & error corrections

In the September 30, 2025 quarter, 22 companies filed 25 amended reports to disclose restatement-related information. The number of restatement-related amendments in Q3 2025 declined by about 30% compared to 36 restatement-related amendments filed in Q3 2024.

Based on the checkbox disclosure on the cover page, seven companies considered the error corrections a restatement in the context of Rule 10D-1. In four cases, the errors necessitated a compensation recovery analysis, and none of the restatement triggered mandatory recoupment under the company’s clawback policy.

While companies with an unchecked error correction box reported a mix of Big R, little r, and clerical errors, all seven companies with a checked error correction box reported a material Big R restatement.

Restatements with the error correction box checked in accordance with Rule 10D-1

On July 2, 2025, PATHWARD FINANCIAL, INC. (Ticker: CASH) filed an 8-K Item 4.02, warning investors that the previously filed financial statements for the years ended September 30, 2024, and 2023, and certain interim periods, to correct errors in gross vs. net presentation of third-party lending and servicing relationships and to fix the related derivative and credit-enhancement accounting within the Consumer Solutions business (emphasis added):

“The errors relate to the Company’s gross vs. net basis presentation and derivative accounting, and financial reporting, of certain third-party lending and servicing relationships within the Consumer Solutions business, within held-for-investment loan balances. These types of arrangements are within consumer finance portfolios and amount to $207.0 million as of March 31, 2025 and $218.3 million as of September 30, 2024, and are included in the Company’s total loans and leases (net), which were $4.39 billion at March 31, 2025 and $4.03 billion at September 30, 2024. Certain third-party providers offered various credit enhancements with respect to loans originated under these programs, including contributions to reserve accounts, yield maintenance and certain other payments. Historically, the Company accounted for all borrower payments and credit enhancement payments under these programs on a single unit or net basis, with all such payments presented as interest income representing the Company’s effective yield on the portfolios. The Company has determined that these payments should instead be accounted for on a separate unit of account or gross basis, with loan yields and interest income recorded at the gross borrower loan rate, and credit losses and associated provisions for credit losses recorded on a gross basis over the life of the loans, and with all credit enhancement payments recorded separately as received.”

Based on an amended 10-K filing dated August 29, 2025, the restatement decreased the retained earnings as of September 30, 2024, by $17.4 million.

Credit enhancements are contractual loss-protection features – not unlike insurance - that may cushion lenders from credit losses; getting them wrong can misstate credit-loss provisions and related assets and liabilities. Notably, Pathward is the second company in 2025 to restate accounting errors associated with credit enhancements on consumer lending programs.

On April 7, 2025, Bancorp Inc. (Ticker: TBBK) filed an amended annual report to correct accounting for allowance for credit losses and recoveries under the enhanced credit agreements. I discussed Bancorp’s restatement and accounting for credit enhancements in detail in my previous post:

“In the amended annual report filed on April 7, 2025, Bancorp increased the allowance for credit losses in the fintech segment by $12.9 million, or 2.8% of the total consumer fintech loans of $454.3 million. The total allowance for credit losses was updated by a similar amount, and a separate “credit enhancement” line with a balance of $12.9 million was added to the balance sheet.”

Bancorp’s restatement was related to a separate presentation of a credit-enhancement asset and corresponding allowance. In contrast, Pathward’s restatement appears to correct a broader net vs. gross accounting issue that affects timing and classification of payments and income. Yet, a disclosure of two material restatements related to credit enhancements in such a short period of time - just a few months apart - suggests that accounting for credit enhancements is a complex, specialized area of accounting prone to errors, which warrants more attention.

A Critical Audit Matter (CAM) is an issue the auditor had to tackle that relates to material accounts or disclosures and involves especially challenging, subjective, or complex judgment. CAMs don’t change the audit opinion, but they tell investors where the most challenging audit work was. Following the restatement, Pathward’s auditor, Crowe LLP, included a credit enhancement CAM noting that credit enhancements are difficult to audit due to “the nature and extent of audit effort required, including the need for individuals with specialized knowledge”.

Labeling the credit-enhancement area as a CAM indicates that auditing Pathward’s gross-vs-net accounting and related credit enhancements necessitates additional effort and specialized expertise, making it noteworthy when evaluating the accounting and disclosure practices of other companies with credit enhancement programs.

Restatements with an unchecked error correction box

Rule 10D-1 requires companies to check the error correction box if the annual financial statements or footnotes contained in the 10-K filing were restated to correct an accounting error. Notably, the checkbox requirement does not apply to quarterly-only restatements or errors corrected as an aggregate out-of-period adjustment in the current quarter. Thus, we should reasonably expect that the restatement-related amended 10-Ks with the blank error correction box were to correct errors that are not subject to Rule 10D-1 requirements.

Based on my review of 10-K/A filings, several companies left the checkbox unchecked for disclosure-only edits that didn’t change amounts (e.g., clarifying the CODM performance measure under ASC 280) or clerical and data-entry errors. However, a subset of companies did not check the error correction box for what appears as little r errors (e.g., cash-flow classification mistakes), where filers likely concluded - rightly or not - that Rule 10D-1 wasn’t triggered.

Specific examples are available for paid subscribers after the paywall.