When auditors are bypassed: annual reports filed without an auditor's consent or opinion

This analysis focuses on risks involved in filing annual reports without an auditor consent or opinion

Public companies are required to file audited annual financial statements to provide investors with reliable, independently verified financial information. These audits, performed by independent external accounting firms, ensure that the financial statements are prepared in accordance with US or foreign accounting principles. Upon the completion of the audit, the audit firm signs an audit opinion, which should be included in the annual report, confirming the auditor’s conclusion on whether financial statements are presented fairly.

Filing unaudited annual reports is a risk to investors because the financial statements may not include the necessary adjustments and may need to be restated. Moreover, the communication failure between the auditor and management that led to the release of the unaudited financial statements may suggest that the internal processes are not properly set and that there is a material weakness in disclosure or internal controls.

In this analysis I focus on the following scenarios that, in my view, present a risk to investors:

Annual reports filed without the auditor approval or while the audit was incomplete;

Unaudited annual reports that omit an audit opinion;

Quarterly report filed without the review of the auditor;

Annual reports that include a disclaimer of an opinion.

Between January 1 and April 15, 2025, two companies, Bancorp, Inc. and Spire Global, Inc., filed their annual reports without receiving consent from their auditors. Behind the paywall, I list nine companies that filed unaudited annual reports or interim reports that did not include a review by the audit firm in 2024.

Bancorp, Inc. and allowance for credit losses

On March 4, 2025, Bancorp, Inc. (Ticker: TBBK) filed an 8-K filing, announcing that the financial statements included in the annual report filed on March 3, 2025, cannot be relied upon because the Company did not receive approval from the Company’s independent auditor, Crowe LLP, concerning the audit of fiscal 2024 financial statements:

“On March 3, 2025, The Bancorp, Inc. (the “Company”) inappropriately filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “Annual Report”). After receiving notification on March 3, 2025 from the Company’s independent public accounting firm, Crowe LLP, on March 4, 2025, the Audit Committee of the Board of Directors concluded that the Company’s filed financial statements for the fiscal years ended December 31, 2022 through 2024 as shown in the Annual Report, should no longer be relied upon because the Company’s independent public accounting firm, Crowe LLP, did not provide final approval to include the audit opinion with respect to the fiscal year ended December 31, 2024 and the consent to the incorporation by reference of the audit report in certain registration statements that were included with the Annual Report.“

According to the Company, the contentious issue was related to the allowance for credit losses (ACL) of the Company’s consumer fintech segment.

“The Company is working expeditiously to perform and complete additional closing procedures related to accounting for consumer fintech loans in the allowance for credit losses and to file an amended Annual Report on Form 10-K/A to issue its financial statements for the fiscal years ended December 31, 2022 through 2024 to include Crowe’s and Grant Thornton LLP’s audit opinions and related consents. The Company is evaluating the impact of this non-reliance on its conclusions regarding disclosure controls and procedures and internal control over financial reporting.”

In a subsequent 8-K filing, Bancorp disclosed that the company expects to record additional ACL provision related to consumer fintech loans.

As I explained to The Capitol Forum, the failure to obtain audited financial statements and expected ACL adjustments point to accounting and process issues at Bancorp:

“Based on the disclosure, the allowance for credit losses was likely not stated correctly at the end of the year and required an auditor-imposed period end adjustment. The key question here is materiality - what is the magnitude of the adjustment? We do not know the magnitude yet, but this is an accounting issue. Next, the 10-K was released without an approval from the auditor. This is a process issue, and arguably adjustments to the previously released numbers exacerbate it because it means that the audit was incomplete, and it was not a technicality such as a missing signature.”

Let’s dig deeper into the underlying accounting issues.

Based on the 10-K filing, consumer fintech loans consist of short-term loans such as fixed-term loans and payroll advances, some of which are unsecured and thus are high-risk:

“In 2024, the Company began making consumer fintech loans in conjunction with marketers and servicers. These loans consist of short-term extensions of credit including secured credit card loans, fixed term loans, payroll advances and others. While credit cards are secured by deposit balances, the other extensions of credit in the consumer fintech lending programs are not. While the sale of such loans and other mitigations are utilized to manage risk, these loans are at risk of complete loss if not repaid.“

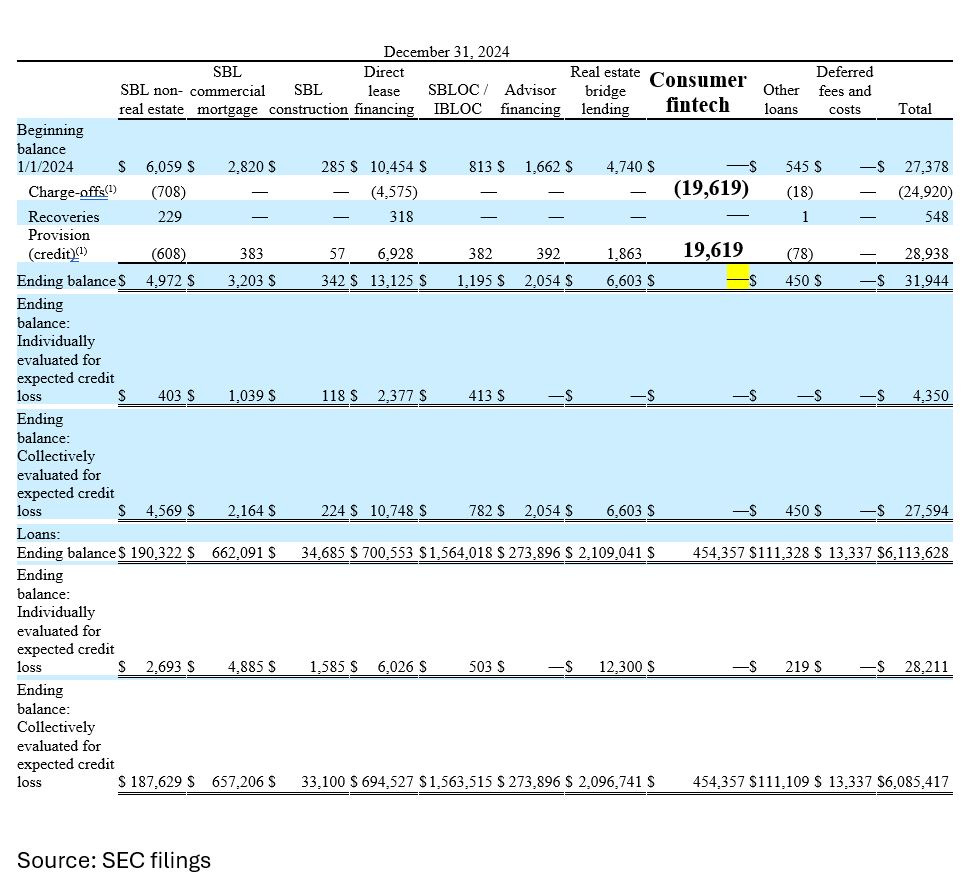

Yet, in the original 10-K filing, the ACL provision for the fintech segment was set at zero. As reported in the original 10-K (emphasis added):

Allowance for credit loss should be based on an estimate of future economic losses. This begs the question: why would Bancorp estimate future losses related to a high-risk segment at zero and record no allowance?

Based on the 10-K filing, Bancorp uses credit enhancements to mitigate the risk. In 2024, the recoveries under the credit enhancements were correlated with the charge-offs – resulting in no economic loss to the Company.

However, accounting rules require that the allowance for credit losses and recoveries under the enhanced credit agreements should be estimated and reported separately on the balance sheet. From a memo by Grant Thornton:

“Regardless of the recognition and measurement model an entity applies, a recognized insurance recovery asset should be presented on the balance sheet separately from the allowance for credit losses associated with the underlying financial asset, as well as on the income statement separately from the credit loss expense.”

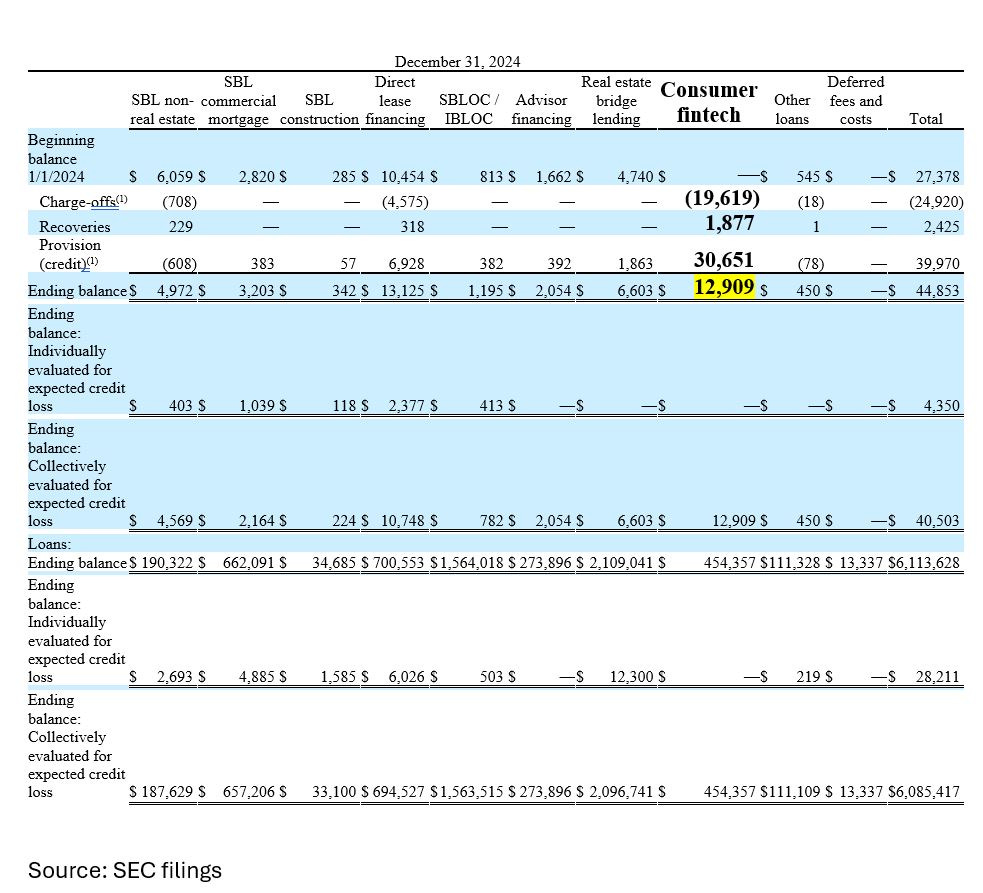

In the amended annual report filed on April 7, 2025, Bancorp increased the allowance for credit losses in the fintech segment by $12.9 million, or 2.8% of the total consumer fintech loans of $454.3 million. The total allowance for credit losses was updated by a similar amount, and a separate “credit enhancement” line with a balance of $12.9 million was added to the balance sheet.

From the amended 10-K filed on April 7, 2025 (emphasis added):

According to Bancorp, the expected recoveries under the credit enhancement agreements are correlated with the estimated credit losses, resulting in no net income effect:

“Lending agreements related to consumer fintech loans resulted in the company recording a $30.7 million provision for credit losses and a correlated amount in non-interest income resulting in no impact to net income.”

Yet, credit enhancements are not a free lunch because they may carry a difficult-to-estimate counterparty risk and involve steep costs. If we think about credit enhancements as an insurance product – what are the odds that the price may go up in a subsequent period if, for example, the economy rolls into a recession and the actual charge-offs exceed the estimate?

Notably, the Bancorp’s auditor, Crowe LLP, identified auditing credit enhancements as a Critical Audit Matter (CAM), citing the complexity and specialized knowledge required:

“The Company has an agreement with a third party to originate and service consumer fintech loans that are included in the Company’s held for investment portfolio as described in Note B and Note E to the financial statements. The Company recorded a credit enhancement asset of $12.9 million as of December 31, 2024 related to the agreement associated with loans recorded on the balance sheet as of December 31, 2024. The Company also recorded a $12.9 million allowance for credit losses for these consumer fintech loans at December 31, 2024. Additionally, a material weakness was identified by the Company related to the accounting and financial reporting associated with the credit enhancement contained within the third-party agreement and its impact on the allowance for credit losses.

We identified auditing the accounting associated with the credit enhancement contained within the third-party agreement as a critical audit matter. The principal consideration for our determination was the nature and extent of audit effort required, including the need for specialized knowledge outside the engagement team.”

While filing the amended 10-K and revising the financial statements are a step in the right direction, Bancorp still has several outstanding issues, including finding a permanent replacement for their CFO, who retired on March 28, 2025, and remediating the material weakness related to the credit enhancements. Given the complexity and materiality of the accounting issues, Bancorp will likely face an increase in audit fees.

Spire Global, Inc. and going concern opinion

On April 4, 2025, Spire Global, Inc. (Ticker: SPIR) disclosed that the financial statements included in the annual 10-K report filed on March 31, 2025, cannot be relied upon because they were filed without the consent of the Company’s audit firm, PwC:

“On March 31, 2025, immediately after the Company filed the Annual Report, PwC notified the Company that, as PwC had communicated to the Company before it filed the Annual Report, it had not yet completed the required audit procedures necessary to complete the audit. Therefore, PwC had not provided its approval to include the audit report in the Annual Report and had not consented to the incorporation by reference of such audit report in certain registration statements, as described in the above paragraph. Subsequently, on April 3, 2025, the audit committee of the board of directors of the Company (the “Board”) formally concluded that the Company’s consolidated unaudited financial statements as of and for the fiscal years ended December 31, 2024 and 2023 included in the Annual Report should not be relied upon because of all of the deficiencies identified above.”

The Company also noted that it expects to report an additional material weakness related to the lack of communication between the accounting and financing teams with regard to the documents filed with the SEC:

“…in addition to the previously disclosed material weaknesses in internal control over financial reporting, the Company’s disclosure controls and procedures were not effective as of December 31, 2024 because the Company did not design and maintain effective policies and procedures related to the communication between the finance and accounting teams regarding the status of the review and approval of documents to be filed with the SEC.”

The amended 10-K was filed on April 4, 2025, and included additional bad news that were not disclosed in the original 10-K – namely, the paragraph in the PwC’s opinion related to existence of a substantial doubt about the Company’s ability to continue as a going concern (emphasis added):

“As previously disclosed in the Form 12b-25 filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2025, on March 31, 2025, Spire Global, Inc. (the “Company”) inappropriately filed its Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”) prior to the completion of the audit by its independent registered public accounting firm, PricewaterhouseCoopers LLP (“PwC”). PwC did not provide approval to include the audit report with respect to the year ended December 31, 2024 in the Annual Report and did not consent to the incorporation by reference of such audit report in certain registration statements. In addition, the version of the audit report included in the Annual Report, which PwC did not sign, omitted a paragraph disclosing substantial doubt about the Company’s ability to continue as a going concern. As a result, the Company is filing this Annual Report on Form 10-K/A for the year ended December 31, 2024 to correct these deficiencies.”

Note that the Company provided the management’s discussion of the liquidity risks and going concern issues in the footnotes and MD&A section in both the original and amended 10-Ks.

Annual reports that fail to include audit opinions

Importantly, Bancorp and Spire Global’s auditors raised the alarm about filing unaudited financial statements, prompting the companies to alert investors by filing an 8-K Item 4.02 that the previously filed financial statements cannot be relied upon. However, some companies file unaudited financials without issuing such an alert.