Red Flags in Amended Annual Reports - Quarterly Update #7

Amended annual reports deserve investor's attention because they often deliver bad news.

Why are amended 10-Ks important?

Businesses frequently submit revised annual 10-K reports to make technical changes, such as filing proxy information or correcting minor typos. These amendments are typically routine and hold little significance for investors.

Nevertheless, some amended reports convey adverse developments, such as the discovery of inaccuracies in previously submitted financial statements or reporting deficiencies in internal controls. These revisions warrant scrutiny because the disclosed negative information may be substantial, and the amended filing could serve as the initial source for announcing such developments.

Amended 10-K filings - quarterly update # 7

In this quarterly update, I examine the reasons for the 10-K/A amendments filed between April 1, 2025, and June 30, 2025. (Quarterly update # 6 is available here.)

Companies filed 401 amended 10-K reports in the June 30, 2025, quarter.

(Company-level data underlying quarterly 10-K/A updates is available to premium subscribers.)

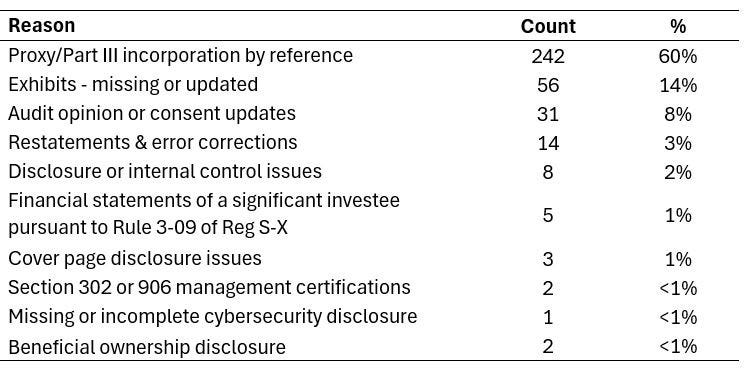

Table 1 below reflects the primary reasons for the amendments.

Table 1 - Primary reasons for amended 10-Ks

Source: SEC filings, analysis by Deep Quarry

The discussion of selected categories and filings is below.

Exhibits

In the June 30, 2025, quarter, companies filed 56 amended 10-K filings to update or add missing exhibits to financial statements – a sharp increase from 24 amendments in the March 31, 2025, quarter. In 40 of the 56 cases, the amendment was filed to add missing Exhibit 97, Compensation Recovery Policy. SEC Rule 10D-1, effective December 1, 2023, requires companies to adopt a policy for recovering erroneously paid compensation following Big R and little r restatements and to file this policy as an exhibit to the annual 10-K report.

As I discussed in my previous post, the first year of implementation was bumpy:

“While the rule sounds simple, Bloomberg, citing my analysis, has pointed out that in the first half of 2024, implementation was inconsistent, with only a fraction of companies having a recovery analysis box flagged. The trend continued into the second half of 2024.”

I also noted that, while recovery analysis disclosures improved in Q1 2025, inconsistencies in how companies reported or referenced their clawback policies—including the sharp decline in Exhibit 97 filings —suggest that companies still have some areas to refine.

Amendments to replace opinions of audit firms with revoked registrations

In the June 30, 2025, quarter, 31 10-K/As were filed to correct or modify the information contained in audit opinions or auditors’ consents. Like the previous quarters, most issues involved technical updates, such as correcting the opinion's signature dates or city references.

However, four companies filed an amended annual report to replace the audit opinions of BF Borgers, Gries & Associates, LLC, and Yusufali & Associates, LLC, whose registrations had been revoked. Three of these companies had to restate their previously filed financial statements following the reaudit.

Public companies previously audited by BF Borgers, Gries & Associates, and Yusufali & Associates must retain a new PCAOB-registered audit firm. Furthermore, companies are prohibited from including audit opinions issued by unregistered audit firms in their 10-K filings or presenting quarterly financial statements reviewed by unregistered audit firms in their 10-Q reports.

It has been about a year since the May 3, 2024, sanctions imposed by the SEC on Borgers. Hiring a replacement audit firm and filing the reaudited financial statements should be a priority for companies in regaining compliance with SEC filing requirements. This raises a question: Why did it take almost a year for some companies to file the reaudited financials?

The disclosure by NEXT-ChemX Corporation (Ticker: CHMX) suggests that the busyness of their new audit firm could explain the delay (emphasis added):

“On May 3, 2024, the Company was made aware that its long standing auditors, BF Borgers CPA PC, had been denied the privilege of appearing or practicing before the Securities and Exchange Commission (the “SEC”) as an accountant. In view of the nature of the actions taken by the SEC in relation to the Company’s former auditor, the SEC required the Company to reaudit 2 years of its financial statements resulting in a deficiency in the Company’s filings entirely due to circumstances beyond the control of the Company. The Company appointed a new registered public accounting firm: Fruci & Associates II PLLC, Certified Public Accountants based in Spokane, Washington (“Fruci & Associates”) to replace BF Borgers. However, due to a vastly increased workload, Fruci & Associates was unable to complete the reaudit of the 2023 Annual Report on Form 10-K originally filed on April 1, 2024.”

Based on my previous analysis, Fruci and Associates substantially increased its workloads by picking up former Borgers clients:

“According to Form AP, Fruci & Associates II, PLLC had four engagement partners that audited 54 clients in the past year. Bloomberg recently reported that the audit firm picked more than a dozen former Borgers clients, expanding its public audit practice by about 20%. “

Academic research suggests that when audit partners handle a high volume of engagements, audit quality can suffer. While Borger’s clients are small and their audits likely straightforward—making a higher workload less immediately concerning—partner workload remains a key metric worth keeping an eye on.

The list of companies with amended annual reports filed during the June 30, 2025, quarter to replace the opinions of BF Borgers, Gries & Associates, and Yusufali & Associates is available after the paywall to paid subscribers.

Amendments related to missing audit opinions or consents

Public companies are expected to file annual financial statements that have been audited by an independent auditor, providing investors with confidence that the financial statements comply with accounting standards and fairly represent the company’s financial position. Filing financial statements without the auditor’s consent raises concerns about unresolved audit issues, potential misstatements, or failed communication between management and the auditor. (See my previous post on reports filed without an auditor’s consent.)

In the June 30, 2025, quarter, two companies, Spire Global, Inc. (Ticker: SPIR) and Finnovate Acquisition Corp. (FNVTF), filed amended 10-K filings, citing previously incomplete audits of the original 10-Ks.

Spire Global disclosed in its amended 10-K filed on April 4, 2025, that the original 10-K was filed without authorization from the Company’s audit firm, PwC. The amended report included additional bad news that was not disclosed in the original 10-K – namely, the paragraph in the PwC’s opinion related to the existence of a substantial doubt about the Company’s ability to continue as a going concern.

Finnovate Acquisition disclosed in its amended 10-K filed on June 11, 2025, that the original 10-K was filed when the Company’s former auditor, Marcum LLP, had not completed the audit and did not sign the audit opinion or provide an authorization to include the opinion in the annual report. The amended 10-K did not disclose a restatement or changes of internal or disclosure controls compared to the original 10-K filing.

Restatements & error corrections

In the June 30, 2025, quarter, 14 companies filed amended reports to disclose restatements-related information. Based on the checkbox disclosure on the cover page, six companies considered the error corrections a restatement in the context of Rule 10D-1. In five cases, the errors necessitated a compensation recovery analysis, and in one case, the restatement triggered mandatory recoupment under the company’s clawback policy.

ADTRAN Holdings, Inc. (Ticker: ADTRN) disclosed in its amended 10-K report filed on May 20, 2025, that the Company needs to restate its previously filed financial statements for the years ending December 31, 2024, and December 31, 2023, to correct errors in inventory accounting of the Company’s wholly-owned subsidiary, Adtran Networks SE. The Company also corrected other immaterial errors, such as inventory-related adjustments in the Company's U.S and Australian subsidiaries, and an understatement of goodwill and an overstatement of a tax receivable. The restatement increased the previously reported 2024 Net Loss Attributable to Adtran Holding by approximately $9 million, or about 2%, to $459.9 million. Additionally, Adtran identified several material weaknesses, including a material weakness in inventory-related control and a weakness related to communication of “accurate information internally and with those charged with governance”.

As a result of its restatement, reported as a Big R restatement, Adtran concluded that a portion of 2024 cash bonuses awarded to officers based on overstated Adjusted EBIT was erroneously paid and is subject to recovery under the company’s clawback policy, though the total amount to be recouped has not yet been determined.

Restatement-related recoupments are uncommon, with fewer than 3% of the restatements reported in Q1 2025 resulting in a clawback.

Disclosure or internal control issues

In the June 30, 2025, quarter, eight amended 10-K filings disclosed revisions of disclosure control or internal control reports. Two companies identified an additional Internal Control (ICFR) or Disclosure Control (DCP) weakness that was not reported in the original report, and one company filed an amended 10-K to include a management ICFR report that had been omitted entirely from the original 10-K.