SEC Compensation Recovery Rule: Restatements and Related Clawbacks, Quarterly Update # 1

A quarterly review of compliance trends, SEC comment letters, and the complexities of recovery analysis

SEC Rule 10D-1, also known as the compensation recovery rule, requires publicly traded companies to adopt policies for recovering erroneously awarded incentive-based compensation from current and former executives in the event of a financial restatement. Mandated by the Dodd-Frank Act, the rule aims to hold executives accountable by clawing back excess compensation that was granted based on misstated financial results, regardless of whether the misstatement was caused by unintentional error or intentional misconduct. The requirement applies to material (Big R) and immaterial (little r) restatements.

The provisions of the rule require companies to check mark the cover page of the annual reports when the report includes error corrections of the annual periods. Companies must also provide a recovery analysis, explaining whether any compensation was recovered following the restatement, and attach their recovery policy as an exhibit to the annual report.

While the rule sounds simple, Bloomberg, citing my analysis, has pointed out that in the first half of 2024, implementation was inconsistent, with only a fraction of companies having a recovery analysis box flagged. The trend continued into the second half of 2024.

The thorny implementation, reflected in a gap between the number of companies selecting the error correction box and those providing a recovery analysis, suggests that companies might have struggled to interpret which restatements require disclosure and clawback analysis and when boxes must be checked on annual report cover pages.

To address the inconsistencies, the SEC issued a series of Compliance and Disclosure Interpretations (C&DIs) in April 2025, clarifying key issues. The guidance confirmed that both material ("Big R") and immaterial-but-cumulative ("little r") restatements require the error correction box to be marked, but out-of-period adjustments do not. It also explained that a recovery analysis must be provided even when no clawback is triggered or the metrics used to establish the performance-based payouts were unaffected. Ultimately, these C&DIs aimed to bridge the gap between the rule’s intentions and its complex application, helping issuers navigate the compliance nuances.

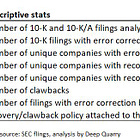

The table below reflects number of companies that checked the error correction and recovery analysis boxes in the first quarter of 2025.

Figure 1 – Companies with error correction and recovery analysis boxes selected

Source: SEC filings, analysis by Deep Quarry

The Q1 2025 analysis is based on 5437 10-K and 10-K/A filings, filed on EDGAR between January 1, 2025, and March 31, 2025, by 5221 unique companies.

The comparison between Q1 2024 and Q1 2025 highlights both progress and persistent gaps in the implementation of SEC Rule 10D-1. The number of companies identifying an error correction remained essentially unchanged (140 vs. 141), suggesting consistency in recognizing errors that require checking the error correction box.

Based on SEC C&DIs and remarks during the 2024 AICPA & CIMA conference on the SEC and PCAOB developments, I would expect a high positive correlation between the error correction and recovery analysis boxes. While the proportion of companies following through with the required recovery analysis almost tripled in Q1 2025, increasing to 58 companies in Q1 2025 compared to 20 in Q1 2024, nearly 60% of the companies with the error correction box did not select the corresponding recovery analysis box in the first quarter of 2025.

The recovery analysis disclosure improved in the first quarter of 2025, with 37 of the 58 companies with the recovery analysis flag providing a brief explanation of how the impact of the errors on the payout metrics was determined. (Note that the recovery analysis stats are preliminary since not all proxy filings were filed at the analysis date.)

My analysis of the 37 recovery disclosures revealed that the most common reason for not requesting compensation back was the absence of an impact on compensation metrics – for instance, if bonuses were based on non-financial operational metrics. Other reasons included cases with affected metrics but unaffected payouts, as well as cases where no performance-based compensation was paid during the relevant period.

(Note: company-level data underlying this analysis is available for premium subscribers of Deep Quarry.)

The number of 10-K filings that included the recovery analysis policy attached as Exhibit 97 declined sharply from 117 in Q1 2024 to 34 in Q1 2025. The lower number of recovery policy exhibits is not necessarily a concern that suggests a violation of the disclosure requirements. Several companies in my sample incorporated the clawback policies attached to the annual reports filed in 2024 by reference to their 10-Ks filed in 2025 (see an example here). Additionally, several companies did not attach the recovery analysis to the 10-K/As that included the restatements disclosure because the policy was filed as an exhibit to the original 10-K.

Clawbacks

Out of 141 unique companies that checked the error correction box in Q1 2025, only four enforced a clawback. This low figure is consistent with trends observed throughout 2024 when just two out of approximately 250 companies recouped the previously paid compensation. The low number of clawbacks is not surprising, as most restatements correct minor, quantitatively and qualitatively immaterial errors.

All four clawbacks in my sample were associated with a little r restatement, with the impact on income numbers ranging from 1% to 5.8%. Arguably, the clawback cases – especially those after a little r restatement – warrant investors’ attention.

ASC 250 states that errors that influence executive compensation outcomes or earnings expectations can be qualitatively material, even if the dollar impact is insignificant. Based on the PwC accounting guide, the misstatement could be qualitatively material if it has the effect of:

“…increasing management's compensation - for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation”.

A clawback, by definition, indicates the error did affect compensation—suggesting the original “immaterial” classification may have downplayed the qualitative impact. With that in mind, it is important to note that the materiality determination is likely based on company-specific circumstances that are not publicly disclosed. Thus, investors may want to consider the information mosaic as a whole in materiality assessments rather than relying on any stand-alone metric.

Additionally, when a quantitatively immaterial misstatement leads to a clawback, it implies that performance targets were so narrowly met that even a minor correction tipped the outcome. For example, if an executive bonus was triggered at exactly 100% of a revenue or EPS target, a 1–5% overstatement could have made the difference between receiving or forfeiting an award.

Setting aggressive performance targets is a double-edged sword. While ambitious goals can align management incentives with those of shareholders, they can also create incentives for excessive risk-taking or earnings management to meet aggressively set thresholds.

As I mentioned in my previous post, clawbacks after immaterial little r restatements are not necessarily a sign of wrongdoing. Yet, arguably, no-fault clawbacks may expose weaknesses in accounting reporting or operational performance, thus warranting more scrutiny:

“Let me be clear: I'm not implying that financials were intentionally manipulated, or errors were deliberately left uncorrected. The presence of an incentive to engage in opportunistic behavior doesn’t necessarily mean that such behavior occurred. However, in my opinion, clawbacks associated with no-fault little r corrections do highlight a risk that deserves consideration.”

I discuss the clawback cases and related restatements after the paywall.