SEC Rule 10D-1: the implementation and challenges of the compensation clawback rule

A review of compliance trends, SEC comment letters, and the complexities of recovery analysis in 2024

SEC Rule 10D-1, also known as the compensation recovery rule, requires publicly traded companies to adopt policies for recovering erroneously awarded incentive-based compensation from current and former executives in the event of a financial restatement. Mandated by the Dodd-Frank Act, the rule aims to hold executives accountable by clawing back excess compensation that was granted based on misstated financial results, regardless of whether misconduct occurred.

The provisions of the rule require companies to check mark the cover page of the annual reports when the report includes error corrections. Companies must also provide a recovery analysis, explaining whether any compensation was recovered following the restatement, and attach their recovery policy as an exhibit to the annual report.

While the rule sounds simple, Bloomberg, citing my analysis, has pointed out that in the first half of 2024, the implementation was inconsistent, with only a fraction of the companies with an error correction box check marked, also noting that the recovery analysis is required.

“Of the 205 companies that reported accounting corrections in their annual financial statements so far this year, just 29—less than 15%—said they reviewed the error to see if they needed to force a compensation clawback, according to research firm Nonlinear Analytics LLC. Of those that conducted a review, two—payments technology provider NCR Voyix Corp. and fintech company Katapult Holdings Inc.—forced executives to return portions of their bonuses.”

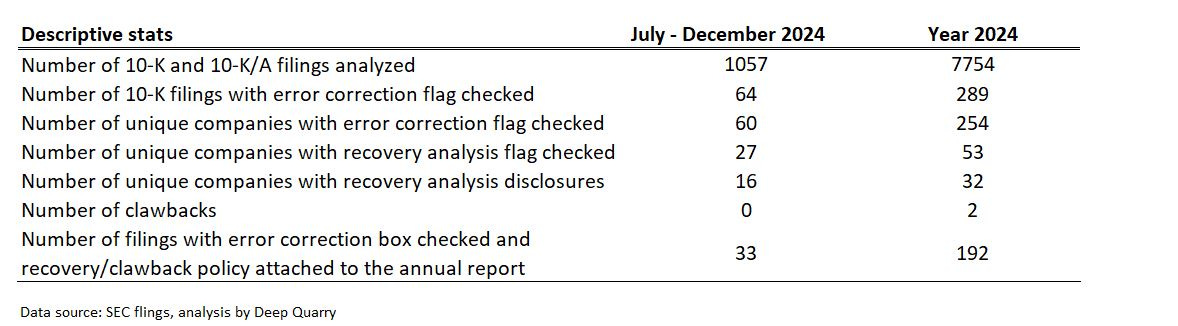

The trend continued into the second half of 2024, with 60 companies selecting the error correction box and 27 selecting both the error correction and recovery analysis boxes.

(Note: company-level data underlying this analysis is available for premium subscribers of Deep Quarry.)

Table 1 – Count of companies with error correction and recovery analysis boxes selected

During the 2024 AICPA & CIMA conference on the SEC and PCAOB developments, SEC staff noted that companies must provide the recovery analysis for all non-voluntary Big R and little r restatements subject to Rule 10D-1 requirements – even if no incentive-based compensation was received during the recovery period.

Deloitte provided a great recap of the SEC’s observations:

“Second Checkbox

Ms. Rosenberger highlighted that the purpose of the second checkbox is to indicate whether, as a result of the error corrections related to the first checkbox, a recovery analysis would be required. She also clarified that:

A “Big R” or “little r” restatement would trigger a requirement to select the second checkbox; however, a voluntary error correction would not.

The checkbox must be selected even if no incentive-based compensation was received by executive officers during the prescribed recovery period.

The checkbox must be selected even if incentive-based compensation received by executive officers during the recovery period was not based on financial reporting measures affected by the restatement.”

Based on SEC remarks, we should see a high positive correlation between the two boxes as we approach the second year of implementation.

Recovery analysis

Of the about 250 companies that checked the error correction box in 2024, two invoked the clawbacks. A review of a sample of about 30 recovery analysis disclosures revealed four broad justifications for not requesting the compensation back following a restatement:

The restatement did not affect the performance metrics used for compensation purposes (about 53% of the sample). For instance, U.S. Global Investors, Inc. (Ticker: GROW) disclosed in its 10-K filed on September 10, 2024, that the Compensation Committee determined that no compensation recovery is needed because the immaterial correction related to uncertain tax positions did not impact pre-tax income, which was the basis for incentive-based compensation calculations.

No performance-based compensation was awarded during the applicable restatement period (about 13% of the sample). For instance, Key Tronic Corp. (Ticker: KCCC) disclosed in its proxy statement filed on October 28, 2024, that the Compensation Committee determined that no compensation recovery is needed because “…the covered executives did not receive any incentive-based compensation on or after October 2, 2023.”

The restatement affected the performance metrics but did not affect the payouts (about 17% of the sample). This category warrants a more detailed discussion (see below).

A general statement that no recovery is required (about 17% of the sample).

For financial metrics such as EBITDA, calculating excess compensation is mostly mechanical. In the absence of discretionary considerations in granting the original compensation, the excess compensation is the difference between the amount that would have been paid based on the restated metric less the amount actually paid.

However, excess compensation for stock-based metrics such as TSR is more difficult to calculate. (A Latham & Watkins LLP FAQ outlines selected practical considerations in Question 12. I also found a blog post from Equity Methods interesting.)

While Rule 10D-1 mandates that for stock-based metrics, the amount of erroneously awarded compensation "…may be determined based on a reasonable estimate of the effect of the accounting restatement on the applicable measure", the rule does not prescribe a specific estimation method.

Three companies in my sample indicated that the Compensation Committee considered the impact of the restatement on TSR in the recovery analysis. Two of these companies noted that a compensation consultant was involved in the process of analyzing impact of the errors on the compensation metrics.

Let’s look at an example of the TSR-related recovery disclosure. Curtis-Wright Comp. (Ticker: CW) disclosed in its 10-K filed on February 20, 2024, that the Company identified during the third quarter of 2023 an immaterial error in a long-term contract within its Naval & Power segment, primarily impacting 2020 and 2021. After analyzing the impact of the immaterial restatement on executive incentive compensation, the Compensation Committee concluded that the Company's total shareholder return (TSR) and performance share unit (PSU) payouts remained unchanged, meaning no excess compensation was received, and recovery under the Dodd-Frank Clawback Policy was not required:

“The Committee, the Company’s outside legal counsel, and the Committee’s independent compensation consultant Frederic W. Cook & Co., Inc. (“FW Cook”) performed an analysis of the impact that the immaterial restatement discussed immediately above (the “Immaterial Restatement”) had on the Company’s past and future payouts under its incentive compensation plans, and whether recovery of such incentive compensation payouts is required under its Dodd-Frank Clawback Policy…

…The receipt of performance share units (PSUs) under the LTIP in early 2024 was based on Company total shareholder return (TSR) relative to its peer group for the 2021 – 2023 performance period. The Company performed an analysis assessing the impact of the Immaterial Restatement on its TSR and the payouts associated with its TSR. After reviewing the relatively minor financial impacts to 2021 and 2022 performance the Committee reasonably estimated that the Immaterial Restatement was immaterial to the overall financial results of the Company during this period, and reasonably concluded that the restated financials resulting from the Immaterial Restatement would not have impacted the Company’s TSR and PSU payouts. Additionally, the Committee, after advice from the Company’s outside legal counsel and FW Cook, determined that the payouts would have been 200% of target regardless due to the high levels of Company financial performance even as restated. Therefore, because payment of PSUs was 200% of target without giving effect to the Immaterial Restatement, no excess PSUs were received by the Section 16 executive officers based on the Immaterial Restatement, and therefore, no recovery was required under the Dodd-Frank Clawback Policy.”

Notably, for all three companies with the TSR-related recovery analysis, the restatements were immaterial little r corrections. Academic literature finds that little r errors are generally associated with more modest negative returns than material Big R restatements (Choudhary, Merkley, and Schipper, Contemporary Accounting Research, 2021).

Recovery analysis and quarterly restatements

SEC Staff noted during the December 2024 conference that the requirement to mark the error correction box does not apply to quarterly-only restatements that do not affect annual periods.

From Deloitte’s highlights:

“If a registrant is required to prepare restatements of its quarterly filing before filing its Form 10-K (e.g., Form 10-Q/A), the registrant does not have to mark the first or second checkbox in its Form 10-K if it is making no additional error corrections. However, the registrant must still provide the disclosures required by Regulation S-K, Item 402(w).”

Meredith Ervine, in a blog on CompensationStandards.com, alerted readers about Weil proxy season memo that provided a set of circumstances where a company would be required to recover compensation for a restatement that affected only interim periods (emphasis added):

“Companies should take note that the SEC Staff confirmed through informal guidance that while the 10-K checkbox does not need to be checked as a result of material corrections to interim financial statements where annual periods are not affected by the errors, companies must still provide the disclosures required by Item 402(w). This suggests the possibility that a correction of interim financials could be an accounting restatement that could require a clawback if, for example, incentive-based compensation is based on interim period financial results.”

Regarding quarterly restatements and Item 402(w) requirements, the SEC issued comments to at least one company, seeking clarity on whether a recovery analysis is required for an interim periods restatement.

WM Technologies (Ticker: WM) disclosed on May 24, 2024, that the Company is restating its quarterly financial statements for the first three quarters of 2023 to correct revenue recognition errors. The Company corrected the errors in its 10-K filing for the December 31, 2023 period and check marked the error correction but not the recovery analysis box on the cover page.

The SEC's comment letters to WM Technologies, issued on September 24, 2024, focused on whether the company should disclose information under Item 402(w) of Regulation S-K regarding its financial restatements for the first three quarters of fiscal 2023. In response, the Company explained on October 9, 2024, that its executive incentive compensation was determined based on year-end financial results, which incorporated any necessary adjustments from the restatements. According to the Company, since performance-based compensation was finalized using the corrected full-year financials and time-based RSUs were not linked to financial performance, the company concluded that no erroneously awarded compensation existed, and therefore, no recovery was required.

“Accordingly, the restatement of the Company’s financial statements for each of the first three quarters of fiscal year 2023 in the Form 10-K did not impact the Company’s executive compensation payments because the performance-based portion of the Company’s executive compensation payments was calculated and finalized based on financial results provided in the Company’s year-end financial statements, and the Time-Based RSUs were not granted on the basis of the Company’s performance or financial results. No aspect of the executive compensation decisions, directly or indirectly, for fiscal year 2023 was based on calculations of the financial results of the Company that were subsequently affected by the restatement.”

However, the SEC noted that even when no recovery is necessary, a brief explanation must be disclosed under Item 402(w)(2). The Company acknowledged this and committed to including such disclosures in its future filings, starting with the Form 10-K for the year ended December 31, 2024.

Clawbacks

While SEC Rule 10D-1 mandates clawbacks for both material (Big R) and immaterial (little r) restatements, only two companies in 2024 have had to recover executive compensation, as noted in the Bloomberg article cited above. This isn’t surprising, as most restatements address minor errors that don’t affect compensation metrics.

However, let’s consider a different scenario. SEC’s clawback rule explicitly requires companies to recover overpaid compensation. But what happens if a restatement reveals that performance metrics were previously understated, resulting in executives receiving less incentive compensation than they were entitled to?

According to Audit Analytics’ 2024 restatements report, “…negative restatements made up at least 66% of all restatements with an income impact.” Put differently, 34% of restatements with the net income effect increase net income. Assuming the ratio of positive restatements remains constant, it is plausible that, at least for some errors, the recovery analysis would point to an increase in payout metrics.

Hence, a hypothetical question. Suppose a recovery analysis concluded that performance-based metrics improved following the restatements. In such situations, would contractual agreements, rather than regulatory mandates, dictate changes in compensation payouts? And if so, how much discretion would companies have in determining whether to award the additional compensation?

Speaking of discretion, according to a recent study by compensation consultant Ted Jarvis, all 30 Dow 30 companies have recoupment policies that extend beyond those imposed by the SEC clawback rule. According to the study, companies may ask executives to return part of their compensation for ethical violations, non-compliance with terms of the contractual agreements, misconduct, and disclosure of trade secrets or confidential information. The catch: these provisions are broadly defined, and companies have a lot of discretion in how to apply them.

I recommend a three-part series by The Dig for my readers interested to learn about the history of clawback rulemaking and the challenges involved in enforcing clawback provisions predating Rule 10D-1.

SEC comment letters on compliance with Rule 10D-1

Companies must disclose any actions taken to recover erroneously awarded compensation if an accounting restatement triggered recovery under their compensation recovery policy pursuant to SEC Rule 10D-1. This includes details such as the restatement date, the total amount of compensation subject to recovery, the methodology used to determine the amount, and any outstanding balances at the end of the last fiscal year. If recovery was deemed impracticable, companies must disclose the amounts forgone and the reasons for not pursuing recovery.

If a restatement occurred but did not require recovery, companies must “…briefly explain” why their policy did not mandate clawbacks. This disclosure must appear alongside other executive compensation disclosures in proxy statements and annual reports but is not automatically incorporated into Securities Act filings unless explicitly referenced.

As I noted in my previous post, the term “briefly” leaves room for interpretation about specific details that need to be disclosed, leading some companies to provide minimal disclosure. I also discussed in detail the SEC comment letter to AEON Biopharma and predicted that we will see more SEC comments asking companies to elaborate on their recovery analysis:

“The SEC, seeking more clarity, asked AEON on June 27, 2024, to elaborate on why no clawback was necessary and to ensure future disclosures are filed in the Interactive Data format, as prescribed by the rules….

AEON’s response was straightforward: their executive bonuses were based on non-financial Key Performance Indicators (KPIs) like corporate milestones and product development, with the sole financial KPI related to cash management goals unaffected by the non-cash restatement. Additionally, the company acknowledged the Interactive Data requirement and promised to comply with it in the future. Satisfied with the explanation, the SEC did not pursue the matter further, resolving the issue in just one round of comments.”

And also:

“SEC Director of the Division of Corporation Finance (Corp Fin), Erik Gerding, has emphasized in a speech that reviewing clawback-related disclosures is a top priority of the Corp Fin, so we can expect more scrutiny and comment letters in the near future.”

The SEC issued comments to at least a dozen companies in 2024, seeking clarity on compliance with the new clawback rule requirements. The comments can be broadly divided into four categories: (1) a request to elaborate on why, based on the recovery analysis, no clawback was necessary, (2) a request to provide omitted recovery analysis, (3) a request to provide the recovery analysis in an Interactive Data File in accordance with Rule 405 of Regulation S-T and the EDGAR Filer Manual, and (4) a request to file an omitted compensation recovery policy as an Exhibit 97 to the annual report. Most companies resolved SEC comments in one back-and-forth round of comments.

The list of companies with SEC comments and the corresponding links to the SEC comments are available for paid subscribers at the end of this section.