Red Flags in Amended Annual Reports - Quarterly Update #6

Amended annual reports deserve investor's attention because they often deliver bad news.

Why are amended 10-Ks important?

Businesses frequently submit revised annual 10-K reports to make technical changes, such as filing proxy information or correcting minor typos. These amendments are typically routine and hold little significance for investors.

Nevertheless, some amended reports convey adverse developments, such as uncovering inaccuracies in previously submitted financial statements or reporting deficiencies in internal controls. These revisions warrant scrutiny because the disclosed negative information may be substantial, and the amended filing could serve as the initial source for announcing such developments.

Amended 10-K filings - quarterly update #6

In this quarterly update, I examine the reasons for the 10-K/A amendments filed between January 1, 2025, and March 31, 2025. (Quarterly updates #1, 2, 3, 4, and 5 are available here, here, here, here, and here.)

Companies filed 179 amended 10-K reports in the March 31, 2025 quarter.

Table 1 below reflects the primary reasons for the amendments.

The discussion of selected categories and filings is below.

(Company-level data underlying quarterly 10-K/A updates is available to premium subscribers.)

Audit opinion or consent updates

In the March 31, 2025 quarter, 41 10-K/As were filed to correct or modify the information contained in audit opinions or auditors’ consents. Like the previous quarters, most issues involved technical updates, such as correcting the opinion's signature dates or city references.

However, on January 29, 2025, AMERICAN REBEL HOLDINGS INC (Ticker: AREB) filed an amended annual report to replace the opinion of BF Borgers with that of a PCAOB registered auditor and provide re-audited financial statements. The restatement was related to incorrect accounting for inventory and accounts receivable, incorrect recognition of accruals, errors in accounting for Series A preferred stock and related deferred compensation, incorrect acquisition accounting and subsequent errors in goodwill impairment testing, and adjustments to the right-of-use assets and liabilities. The restatement decreased the 2023 net loss of $11.1 million by about $1.4 million, or 12.3%.

On May 3, 2024, the SEC imposed sanctions on Borgers and prohibited the audit firm from practicing before the SEC. Public companies previously audited by Borgers must retain a new PCAOB-registered audit firm. Furthermore, companies are prohibited from including audit opinions issued by Borgers in their 10-K filings or presenting quarterly financial statements reviewed by Borgers in their 10-Q reports after May 3, 2024, the effective date of the SEC order.

The extensive number of restatements and the wide-ranging nature of errors identified in the re-audited financial statements strongly suggest that many of BF Borgers' clients faced significant accounting issues even before the firm's resignation. In December 31, 2024 quarter alone, eight companies filed amended annual reports to replace Borgers' audit opinions and provide re-audited financial statements.

According to my analysis of Audit Analytics’ restatements data, between May 2024 and April 2025, at least 36 companies disclosed a restatement where Borgers BF was an auditor during the restatement period. Arguably, the influx of Borgers-related restatements should be near the end because most companies with the calendar year-end should file their 2024 financial statements and re-audited 2023 reports by March 31, 2025 deadline.

I discussed Borgers’ restatements in more detail in my previous post.

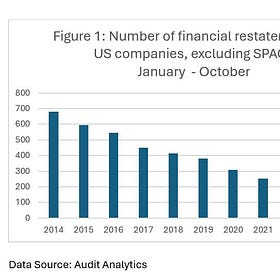

The resurgence of restatements - is uptick here to stay?

Stephen Foley of the FT wrote on December 9, 2024, that public companies are correcting their financial statements in “record numbers”. Importantly, according to data from Ideagen Audit Analytics cited by FT, not only the total number of restatements is up 7% year-over-year but the number of Big R restatements – material restatements that undermine reliance on previously filed financial statements – is at 9-year high.

On March 28, 2025, Agrify Corp (Ticker: AGFY) filed an amended annual report to provide a dual-dated audit opinion of GuzmanGray with respect to the 2023 retroactive application of the reverse stock split. The Company completed the reverse split on October 8, 2024, and engaged GuzmanGray to audit the retroactive application of this transaction.

A dual-dated audit opinion is issued when a significant event occurs after the original audit completion date but before the financial statements are released. While dual-dated opinions are not a red flag, the existence of a dual-dated opinion indicates that the company has undergone significant developments, such as a stock split.

Companies reported 127 dual-dated opinions between January and April of 2025 – a sharp increase from the 34 dual-dated opinions in the comparable period of 2024.

Note: The analysis is based on the number of audit opinions filed between January and April in 10-K reports, as reported in the Audit Analytics Audit Opinions database. Amended annual reports are excluded.

Based on my review of a sample of the filings, the increase in the number of dual-dated opinions is related to the information presented in the segment footnote, likely following the adoption of new FASB ASU No. 2023-07, Improvement to Reportable Segment Disclosures, which requires companies to provide enhanced disclosure about significant segment expenses on an annual and interim basis.

Restatements & error corrections

In the March 31, 2025 quarter, 16 companies filed amended reports to disclose restatements-related information. Based on the checkbox disclosure on the cover page, six companies considered the error corrections a restatement in the context of Rule 10D-1. In four cases, the errors required a compensation recovery analysis.

Restatements and SEC scrutiny

In my analysis of restatement trends, I discussed, using Equity Lifestyle Properties (Ticker: ELS) and Archer-Daniels-Midland (Ticker: ADM) as examples, how SEC scrutiny drives financial restatements by uncovering material errors through comment letters and investigations.

MAUI LAND & PINEAPPLE COMPANY, INC. (Ticker: MLP) is another example of a material Big R restatement driven by SEC scrutiny. On September 13, 2024, the SEC issued comments to MAUI LAND, seeking clarity on whether it was appropriate to classify the $1.6 million land contribution as operating revenue instead of recording a gain on the derecognition of the land.

In its 10-Q for the quarter ending September 30, 2024, the Company acknowledged the incorrect accounting treatment and argued that the error is immaterial (emphasis added):

“In December 2023, the Company entered into a joint venture agreement with a local developer to form a Hawaii limited liability company ("BRE2 LLC"). The Company's initial capital contribution to BRE2 LLC consisted of approximately 30 acres of former pineapple lands in Hali‘imaile valued at $1.6 million. There were no proceeds from the transaction as the land was an equity contribution to the joint venture and was recognized as land development and sales operating revenues. However, after reevaluating the accounting treatment of the transaction, it was determined that the $1.6 million should have been presented as a nonoperating gain on the derecognition of the land rather than operating revenue. The Company does not consider the misclassification to be material and intends on restating the gain in the Company’s Annual Report on Form 10-K for fiscal year 2024, anticipated to be filed in March 2025.”

However, citing the quantitatively material impact, prompting the Company to file an 8-K Item 4.02 and an amended annual report to correct the error. The Company also reported a material weakness in internal control related to accounting treatment of an investment in a joint venture and the related revenue recognition:

"We have considered your response to comment 2 in our letter dated October 17, 2024. Given the quantitative significance of the error and that we do not agree that the factors cited in your qualitative assessment overcome such significance, we disagree with your conclusion that the error was immaterial. Accordingly, we have concluded that your consolidated financial statements for the year ended December 31, 2023 are materially misstated and, therefore, should be restated. Also, in light of the restatement, please reassess your conclusions regarding disclosure controls and procedures and internal control over financial reporting for the impacted periods.

Company Response:

The Company acknowledges the Staff’s position and has agreed to amend and restate its Form 10-K by filing an amended Annual Report on Form 10-K/A for the year ended December 31, 2023 (the “Amended Report”). The Amended Report is being filed concurrently with the filing of this correspondence.

Further, the Company determined there was a material weakness in its internal control over financial reporting as a result of the restatement and, therefore, concluded that its internal control over financial reporting and disclosure controls and procedures were ineffective as of December 31, 2023, which conclusion was disclosed in the Amended Report.”

Disclosure or internal control issues

In the March 31, 2025 quarter, 14 amended 10-K filings disclosed revisions of disclosure control or internal control reports. Five companies disclosed additional material weaknesses not reported in the original 10-K filing.

A discussion of selected amendments is below.

TRIMBLE Inc. (Ticker: TRMB) disclosed in the amended 10-K filed on January 16, 2025, that the Company identified an additional material weakness in internal control related to “…information technology general controls (“ITGCs”), undue reliance on controls over information technology (“IT”) interfaces, and the evaluation of standalone selling prices of performance obligations utilized in accounting for revenue.”

The Company’s audit firm, EY, identified the material weakness during the preparation process for the annual PCAOB inspection. The Company disclosed the EY concerns in an 8-K filed on May 3, 2024. The discovery of a material weakness led the Company to delay the release of its quarterly report for the period ending March 31, 2024.

While the PCAOB inspects audit firms, not issuers, companies occasionally disclose material weaknesses or restatements associated with the audit deficiencies identified during the PCAOB inspections (note that this is uncommon). Trimble’s case is a little different because EY’s internal process identified the material weakness during the preparation for the inspection.

In 2024, at least five companies disclosed additional material weaknesses or restated their financial statements following an auditor’s mid-year review, preparation for the PCAOB inspection, or issues identified during the PCAOB inspection. The list is available to paid subscribers behind the paywall.

New SEC rules – Insider Trading Policies

The SEC's modernized Rule 10b5-1, effective February 27, 2023, enhances transparency and accountability around insider trading by tightening the conditions for Rule 10b5-1 trading plans. Key changes include mandatory cooling-off periods for directors and officers, a certification requirement confirming the absence of material non-public information (MNPI) at the time of plan adoption, and quarterly disclosure of trading plan details. Notably, the rule also introduces a requirement for public companies to file their insider trading policies as Exhibit 19 to their Form 10-K, ensuring that investors have direct access to these policies and can better assess the company’s governance practices regarding insider trading.

In the March 31, 2025 quarter, 12 companies - or about half of the companies that filed an amendment to add an exhibit - amended 10-Ks to update or add missing insider trading policies or disclosures. In my view, having a good checklist that is frequently updated to incorporate new regulatory pronouncements can substantially mitigate the risk of missing a material exhibit, which would require filing an amended annual report.