The resurgence of restatements - is uptick here to stay?

While financial restatements increased 7% year-over-year, the uptick is at least partially attributed to SEC enforcement activity. Changes in enforcement priorities may affect restatement trends.

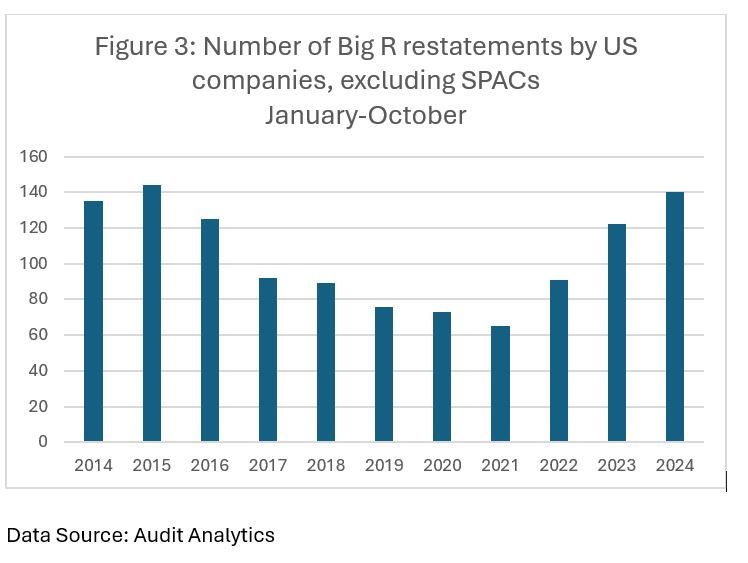

Stephen Foley of the FT wrote on December 9, 2024, that public companies are correcting their financial statements in “record numbers”. Importantly, according to data from Ideagen Audit Analytics cited by FT, not only the total number of restatements is up 7% year-over-year but the number of Big R restatements – material restatements that undermine reliance on previously filed financial statements – is at 9-year high.

The phenomena of disappearing restatements puzzled me for years. Over the past decade, accounting shifted to more principle-based, with several complex, difficult-to-implement standards such as new revenue recognition (ASC 606), leases (ASC 842), and credit losses (ASC 326) standards adopted along the way. There is also an increasing complexity associated with financial instruments and novel asset classes, such as digital assets, for which limited accounting guidance exists. As if complexity wasn't enough, the accounting industry is going through a persistent shortage of accounting talent. Complexity, staffing challenges, and COVID-related remote audits are bound to increase pressure on corporate accountants and auditors, leading to more errors and – consequently – more error corrections.

So where did the restatements go? Did the recent uptick discussed by FT reflect an anticipated reversal of a long-term downtrend in error corrections, or is it just a statistical fluctuation around the mean of around 400 restatements annually, where a reversal to the mean generally follows a temporary uptick? In my opinion, the 2024 upticks in total and Big R restatements are at least partially attributed to more robust enforcement activities.

Restatement trends

First, let’s look at the long-term trends. Figure 1 reflects a 10-year trend as described in FT:

Based on the chart, the restatements declined between 2014 and 2021 and remained at ~ 280 to 300 between 2022 and 2024.

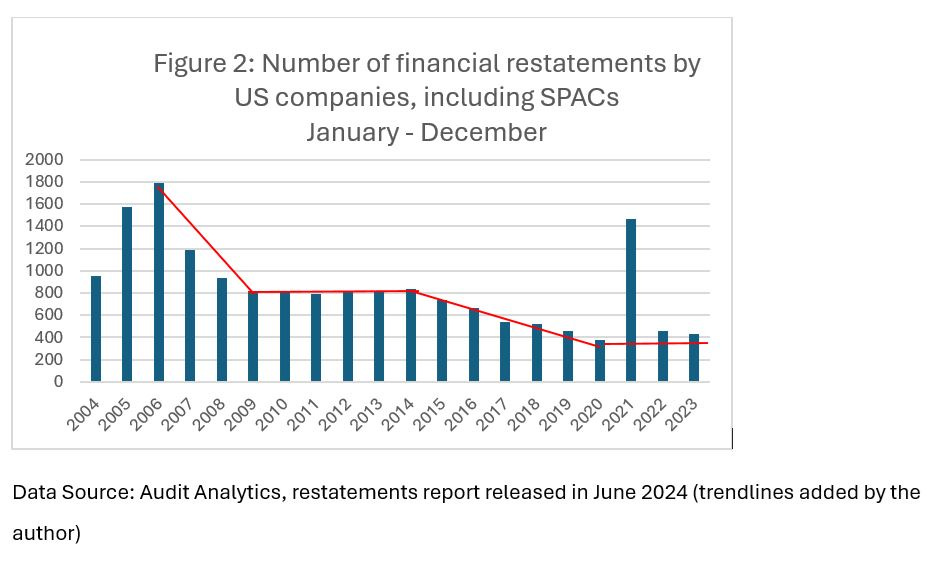

Figure 2 below extends the trend to 2004.

Note: the chart does not include the 2024 data because this data is not available in the Audit Analytics restatements report released in June 2024.

If we exclude the 2021 uptick, primarily attributed to SPACs, and assuming no surprises in November and December of 2024, the 2020-2024 appears to be flat by historical measurements.

The increase in the Big R ratio looks more interesting, with Big R restatements increasing year-over-year since 2022.

Impact of enforcement activity and materiality considerations

At least part of the 2024 increase is attributed to error corrections by former BF Borgers clients, discovered by the new auditors during the re-audit process. Based on my analysis of Audit Analytics restatements data, BF Borgers was an auditor during the restatement period of 12 Big R restatements in the first ten months of 2024 compared to 7 in the first ten months of 2023.

Additionally, the uptick in Big R restatements in the past three years overlaps with a period of increased SEC scrutiny of the materiality of the errors. For instance, SEC Chief Accountant Paul Munter warned that classification-only cash flow errors could be material:

“In certain instances, the staff in OCA have been presented with analyses that conclude an error in the statement of cash flows is not material because it is an error in classification only. We have not found such analyses and their corresponding arguments persuasive since classification itself is the foundation of the statement of cash flows.“

Academics and regulators often use financial restatements to measure audit quality. For instance, DeFond and Zhang, in A Review of Archival Auditing Research, JAE, 2014, argue that restatements provide strong evidence of poor audit quality. All else equal, a higher number of restatements suggests a lower audit quality because auditors missed more errors. However, it is important to recognize that restatements are prone to a detection bias. According to DeFond and Zhang, “…material misstatements allowed by low-quality audits may simply go undetected.” A recent working paper by Dyck, Morse, and Zingales (2023) suggests that the under-detection risk is pervasive, with only about a third of corporate fraud being detected.

In the context of 2024 restatement trends, regulatory enforcement mitigated the lack of detection issue:

Directly – through the SEC Corp Fin comment letters process;

Indirectly – by sanctioning Borgers and forcing former Borgers' clients to replace their auditors thus leading to an uptick in "fresh eyes" restatements.

Understanding the relationship between restatements and enforcement activity is important in understanding the restatement trends because shifts in enforcement priorities or change in budget can affect the number of restatements. For instance, Kubick (2021) finds a positive association between the size of the SEC Corp Fin review team and the error detection rate of the reviews. If, as some experts suggest, the incoming administration pares the SEC enforcement activity, we may see fewer restatements in the next several years.

For those of my readers interested in understanding what the enforcement activity may look like in the next few years, my friend and frequent collaborator Francine McKenna provided a good summary, with a few predictions.

Examples of Big R cash flow and segment restatements that involve SEC comment letters, SEC inquiries, or a dialogue with the SEC

In my quarterly “Red Flags in Amended Annual Report” update I discussed how the SEC challenged EQUITY LIFESTYLE PROPERTIES INC (Ticker: ELS) reclassification from net investment in real estate to other assets on the cash flow statement. The Company initially characterized the error as a reclassification but reported a Big R restatement following the SEC comments:

“For EQUITY LIFESTYLE PROPERTIES INC (Ticker: ELS), the restatement and the amended 10-K were prompted by the SEC's comments. In its May 17, 2023 comment letter, the SEC asked the Company to clarify what issues were included in the reclassification from net investment in real estate to other assets on the cash flow statement. The company acknowledged that the reclassification was to correct an error. The SEC pressed, and on October 25, 2013, the Company reported a little r revision. After additional follow-up comments from the SEC citing the materiality of the errors, the Company determined on January 22, 2024, that the accounting mistakes were material and should be reported as a Big R restatement.”

To the best of my knowledge, historically, Big R segment restatements were uncommon (let me be cautious and caveat this statement on my experience reading restatements disclosure because I do not have hard data to back this statement up). However, during the AICPA conference on the SEC and PCAOB developments, the SEC OCA staff observed that footnote-only errors, such as segment reporting corrections, could be material. According to SEC Staff, Companies should apply qualitative and quantitative considerations to determine the materiality of footnote errors.

The materiality of segment errors came into the spotlight when Archer-Daniels-Midland Company (ADM) disclosed errors in intersegment accounting. The errors were identified during the internal investigation following the SEC's June 30, 2023 inquiries. I discussed the materiality of ADM’s restatement in my March 19, 2024, piece:

“Regulatory inquiries and the Company’s decision to put the CFO on administrative leave raised concerns that the accounting woes are serious. However, the internal investigation identified only immaterial errors—corrected as a “little r” revision—in the intercompany sales between the Nutrition, Ag Services, Oilseeds, and Carbohydrate Solutions segments.”

And also:

“The message conveyed by the regulatory investigation and the CFO's leave is misaligned with the mild language describing the accounting errors. While the former raises concerns about potentially serious accounting irregularities, the latter suggests a minor insignificant accounting issue corrected through a footnote disclosure.”

On November 5, 2024, the Company alerted investors through an 8-K Item 4.02 that it identified additional material errors that inflated certain intersegment sales (emphasis added):

“On November 4, 2024, the Board of Directors (the “Board”) of Archer-Daniels-Midland Company (the “Company”), after discussion with management of the Company and following the Company’s ongoing dialogue with the staff of the United States Securities and Exchange Commission, concluded that the Company will amend its fiscal year 2023 Form 10-K (the “FY2023 Form 10-K”) and Form 10-Qs for the first and second quarters of 2024 (collectively, the “Q1 and Q2 2024 Form 10-Qs”) to restate the segment information disclosure (Note 17 included in the FY2023 Form 10-K and Note 13 included in the Q1 and Q2 2024 Form 10-Qs) for each of the periods included in those filings, including fiscal years 2021, 2022 and 2023 in the FY2023 Form 10-K and each of the quarterly and year-to-date periods included in the Q1 and Q2 2024 Form 10-Qs (collectively, the “Prior Filings”). The Prior Filings should no longer be relied upon because of errors identified in such financial statements, as described below.”

And also:

“In the course of testing new controls implemented as part of the Company’s material weakness remediation plan in the third quarter of 2024, the Company identified additional misclassified intersegment transactions. These newly identified errors concern additional intersegment sales for each of its Ag Services and Oilseeds, Carbohydrate Solutions and Nutrition segments that included certain intrasegment sales and should have included exclusively intersegment sales. The Company also identified some intersegment transactions between Ag Services and Oilseeds and Carbohydrate Solutions that were not accounted for consistently in accordance with revenue recognition and segment reporting standards and should not have been reported as intersegment sales.”

In contrast to March 12, 2024, little r correction, the errors disclosed in November were material and required a Big R restatement. Additionally, the Company used the term "restatement" to describe the correction of the additional errors, while in March, the error correction was described as "revision."

Finally, the Company disclosed that the restatement was prompted by the "ongoing dialogue with the staff of the United States Securities and Exchange Commission", suggesting that the Company could have been either seeking a consultation with the SEC Office of Chief Accountant (OCA) about a specific accounting treatment, received comments from SEC Corp Fin, or had a communication with the SEC Division of Enforcement. Suppose the "dialogue" refers to SEC comments. While materiality analysis is generally not public and thus unobservable, sometimes SEC Corp Fin comment letters can shed light on the materiality considerations. Note that Corp Fin comment letters are typically disseminated on EDGAR about a month after the resolution of all comments. The OCA consultations are confidential and thus not publicly available.

While the interaction with the SEC Division of Enforcement is usually described as inquiries not a dialogue, the Division of Enforcement is also investigating the Company’s intersegment accounting. From the 10-Q filing for the period September 30, 2024:

“Intersegment Sales Investigations

On June 30, 2023, the Company received a voluntary document request from the United States Securities and Exchange Commission (“SEC”) relating to intersegment sales between the Company’s Nutrition reporting segment and the Company’s Ag Services and Oilseeds and Carbohydrate Solutions reporting segments, and subsequently received additional document requests from the SEC. In response, the Company engaged external counsel, assisted by a forensic accounting firm, to conduct an internal investigation, overseen by the Audit Committee of the Company’s Board of Directors, which is separately advised by external counsel (the “Investigation”). The Company is cooperating with the SEC. Following the Company’s January 21, 2024 announcement of the Investigation, the Company received document requests from the Department of Justice (“DOJ”) focused primarily on the same subject matter, and the DOJ directed grand jury subpoenas to certain current and former Company employees. The Company is cooperating with the DOJ. The Company is unable to predict the final outcome of these investigations with any reasonable degree of certainty.”

The SEC DOE does not generally provide any updates on the investigations or release findings unless the investigation results in an enforcement action.

For questions and data inquiries please contact olga@deepquarry.com.

Disclaimer: This newsletter does not provide investment advice. The views expressed in this newsletter are personal views of the authors based on their interpretation of publicly available information.