Red Flags in Amended Annual Reports - Quarterly Update #5

Amended annual reports deserve investor's attention because they often deliver bad news.

Why amended 10-Ks are important?

Businesses frequently submit revised annual 10-K reports to make technical changes, such as filing proxy information or correcting minor typos. These amendments are typically routine and hold little significance for investors.

Nevertheless, some amended reports convey adverse developments, such as uncovering inaccuracies in previously submitted financial statements or reporting deficiencies in internal controls. These revisions warrant scrutiny because the disclosed negative information may be substantial, and the amended filing could serve as the initial source for announcing such developments.

Amended 10-K filings - quarterly update #5

In this quarterly update, I examine the reasons for the 10-K/A amendments filed between October 1, 2024, and December 31, 2024. (Quarterly updates #3, and 4 are available here, and here).

Companies filed 114 amended 10-K reports in the quarter ended December 31, 2024.

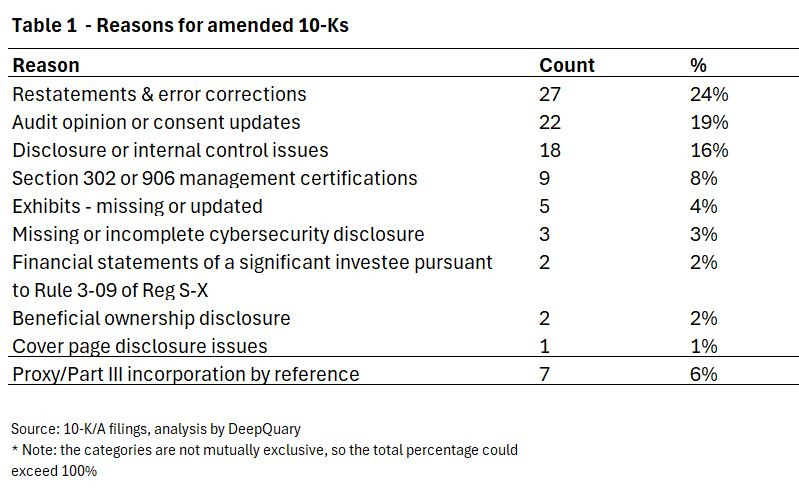

Table 1 below reflects the primary reasons for the amendments.

The discussion of selected categories and filings is below.

(Company-level data underlying quarterly 10-K/A updates is available to premium subscribers.)

Audit opinion or consent updates

In the December 31, 2024 quarter, 22 10-K/As were filed to correct or modify the information contained in audit opinions or auditor’s consents. Like the previous quarters, most issues involved technical updates, such as correcting the opinion's signature dates or city references. However, eight companies filed amended annual reports to replace the opinion of BF Borgers with that of a PCAOB registered auditor and provide re-audited financial statements.

Notably, five of these companies restated their previously filed annual or quarterly financial statements, uncovering errors spanning revenue recognition, acquisition accounting, stock-based compensation, write-offs of accounts receivable and inventory, and more. For instance, Atlas Lithium (Ticker: ATLX) corrected at least eight distinct accounting errors, and OneMedNet Corp (Ticker: ONMD) restated its 2023 EPS loss by over 300%. These findings are consistent with the earlier pattern observed in the September 30, 2024, quarter, where five companies also disclosed 10-K/A restatements after re-audits.

The extensive number of restatements and the wide-ranging nature of errors identified in the re-audited financial statements strongly suggest that many of BF Borgers' clients faced significant accounting issues even before the firm's resignation.

(The list of restating companies that reported the restatements in the 10K/As and a brief description of the restatements are in Appendix A at the end of this update.)

My friend and frequent collaborator Francine McKenna, based on a detailed analysis of former Borgers’ clients-related data, argues that many of the former Borgers’ clients had pervasive weaknesses in the financial reporting and accounting practices, including material weaknesses, going concern opinions and even a company designated as a "Caveat Emptor" by the OTC - that predated the SEC’s May 3, 2024, sanctions against the firm.

“I’ve performed a detailed analysis of the audit firms that picked up the Borgers clients and of the Borgers clients that still haven't found a new audit firm. There are a number of issues I will dig into that emphasize the dismal market landscape which is penny-stock, pink sheet, OTC listings and the audit firms that sign their audits.

After the paywall, going concern zombies, chronic material weaknesses, repeated restatements, flat fees, de-registrations and invalid firms, and audit firms that probably should not have been allowed to take on some of the riskiest, and in some cases skeeviest issuers in the markets.”

Investors should exercise caution when relying on the financial statements of former BF Borgers clients whose financials have not yet been re-audited, as significant errors may still be uncovered. The numerous restatements filed by former Borgers’ clients to date highlight the potential for material restatements of the previously reported numbers. Additionally, more restatements will likely be disclosed as more firms conduct re-audits. Furthermore, these companies are likely to face increased audit fees as they engage new PCAOB-registered firms, with the re-audit process being costly. (See the discussion of re-audit fees for a former Borgers client, Quantum Computing (Ticker: QUBT) here.)

Finally, let me reiterate what I’ve already discussed in several previous pieces - hiring the right audit firm is crucially important:

“While hiring a new PCAOB-registered auditor is essential in complying with the SEC’s directive, companies may want to be mindful of the firm they hire. For instance, nine former Borgers clients engaged Olayinka Oyebola & Co. On September 30, 2024, the accounting firm was sanctioned by the SEC for the firm’s role in Tingo’s accounting scandal. The SEC is seeking to permanently bar the firm from auditing U.S. public companies, which means that companies that switched from Borgers to Olayinka would need to seek a new auditor – again. (A list of Olayinka clients with opinions reported on Form AP is available on the PCAOB site.)

Moreover, as I previously discussed, many firms engaged by former Borgers’ clients are small, and bringing in more clients may significantly increase the workload on the engagement teams. “

On May 3, 2024, the SEC imposed sanctions on Borgers and prohibited the audit firm from practicing before the SEC. Public companies previously audited by Borgers must retain a new PCAOB-registered audit firm. Furthermore, companies are prohibited from including audit opinions issued by Borgers in their 10-K filings or presenting quarterly financial statements reviewed by Borgers in their 10-Q reports after May 3, 2024, the effective date of the SEC order.

Restatements and error corrections

In the December 31, 2024 quarter, 26 companies filed 27 amended reports to disclose restatements-related information. Based on the check box disclosure on the cover page, 15 companies considered the error corrections a restatement in the context of Rule 10D-1. In ten cases, the errors required a compensation recovery analysis.

Restatements and SEC scrutiny

In my analysis of restatement trends, I discussed, using Equity Lifestyle Properties (Ticker: ELS) and Archer-Daniels-Midland (Ticker: ADM) as examples, how SEC scrutiny drives financial restatements by uncovering material errors through comment letters and investigations.

Discover Financial Services (Ticker: DFS) restatement is another example of a material restatement driven by SEC scrutiny. In July 2023, Discover identified and corrected a $365 million error related to misclassifying certain credit card accounts, which resulted in overcharges to merchants. While the Company deemed the revenue impact immaterial to prior periods, it corrected the error as a little r restatement. The incorrect accounting went back to 2007 and reduced the March 31, 2023, retained earnings by $255 million:

“On July 19, 2023, the Company disclosed that beginning around mid-2007, the Company incorrectly classified certain credit card accounts into its highest merchant and merchant acquirer pricing tier (the “card product misclassification”). Based on information available as of June 30, 2023, the Company recognized a liability of $365 million that was accounted for as the correction of an error. The Company determined that the revenue impact was not material to the consolidated financial statements of the Company for any of the impacted periods. While it was therefore determined that it was not necessary for the Company to restate any previously issued interim or annual financial statements, the cumulative misstatement was deemed material to the three and six months ended June 30, 2023 condensed consolidated financial statements, and therefore the Company determined that adjustment of the full $365 million only through 2023 earnings was not appropriate. Therefore, the $365 million liability (the “Initial Liability”) was recorded as of June 30, 2023 with offsetting adjustments to merchant discount and interchange revenue and retained earnings, along with consequential impacts to deferred tax accruals.”

In its Form 10-Q for the first quarter of 2024, Discover disclosed an increase in its liability to $1.2 billion, recorded as a charge to other expenses for the quarter. This adjustment reflected the total amount the company anticipated it would likely need to pay regarding the card product misclassification issue:

“In the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, the Company disclosed that it had determined to increase its liability to $1.2 billion (the “Liability Increase”) through a charge to other expense for the three months ended March 31, 2024, to reflect the total amount the Company then expected was probable to be disbursed in relation to the card product misclassification. The Company determined the Liability Increase was appropriate based on its experience through that date with remediation efforts, discussions through the first quarter of 2024 with its regulators, Board of Directors and other stakeholders, the pending Merger, which was approved by the Company’s Board of Directors during the quarter, and a desire to advance resolution of the matter more quickly to mitigate further risk.”

However, during an SEC review of a merger transaction with Capital One, the agency disagreed with Discover’s accounting treatment under ASC 605 and ASC 606. Following discussions, Discover adopted an alternative approach, correcting the cumulative revenue error to reflect the maximum agreed restitution amount of approximately $1 billion.

The error was deemed material and was disclosed in an 8-K Item 4.02 filed on November 25, 2024, and the restated financial statements were disclosed in an amended 10-K filing dated December 23, 2024.

From the 10-K/A filed December 23, 2023:

“As part of the review of the Company’s historical financial statements by the Staff of the Division of Corporation Finance and the Office of the Chief Accountant of the SEC (the “Staff”) undertaken in connection with the Staff’s review of the Registration Statement on Form S-4 filed by Capital One in connection with the Merger (and the preliminary joint proxy statement/prospectus contained therein) (the “Registration Statement”), the Staff provided comments to the Company relating to the Company’s accounting approach for the card product misclassification. The Staff disagreed with the Company’s application of revenue recognition guidance under Accounting Standards Codification (“ASC”)

Topics 605, Revenue Recognition, and 606, Revenue from Contracts with Customers, in connection with the Company’s measurement of the revenue error and recording of the Initial Liability as of June 30, 2023.

Following discussions with the Staff, management concluded that it was appropriate to correct the revenue error related to the card product misclassification using the maximum amount agreed to be paid by the Company in restitution in respect of the card product misclassification (excluding interest, legal fees and other concessions) (the “Alternative Approach”). Upon recognizing the revenue error correction under the Alternative Approach, the Company will have restated cumulative discount and interchange revenue by a total of approximately $992 million as of June 30, 2023, and $1,047 million as of December 31, 2023. The cumulative revenue error resulting from the card product misclassification will be corrected by reclassifying these amounts from revenue (including through adjustments to retained earnings) to a refund liability consistent with ASC 606-10-32-10.”

Note that it was crucial for the Company to quickly resolve SEC comments because the SEC would generally not declare an S-4 registration effective until all comments are resolved. SEC comments on registration statements are typically publicly released on EDGAR about a month after the registration is declared effective. Investors seeking additional details about why the SEC disagreed with Discover’s accounting treatment may refer to these comments once released.

Disclosure or internal control issues

In the December 31, 2024 quarter, 18 amended 10-K filings disclosed revisions of disclosure control or internal control reports. Six companies disclosed additional material weaknesses not reported in the original 10-K filing.

A discussion of selected amendments is below.