Behind the Curtain of SEC Reviews: Quantum Computing’s Unusual 508-Day Scrutiny

A deep dive into the SEC’s prolonged review of Quantum Computing Inc., uncovering rare comment patterns and potential links to Borgers-related events

My daily routine involves reading dozens of SEC comments and company responses. While most SEC comments are routine and seek minor clarifications of the disclosure, some SEC reviews - for instance, hard-to-resolve conversations or unusual comments - warrant a deeper look.

The SEC comment letters to Quantum Computing Inc. (Ticker: QUBT), a developer of quantum technology for high-performance computing applications, checked several boxes because the review was long and involved unusual comments. First, let’s look at the characteristics of the review.

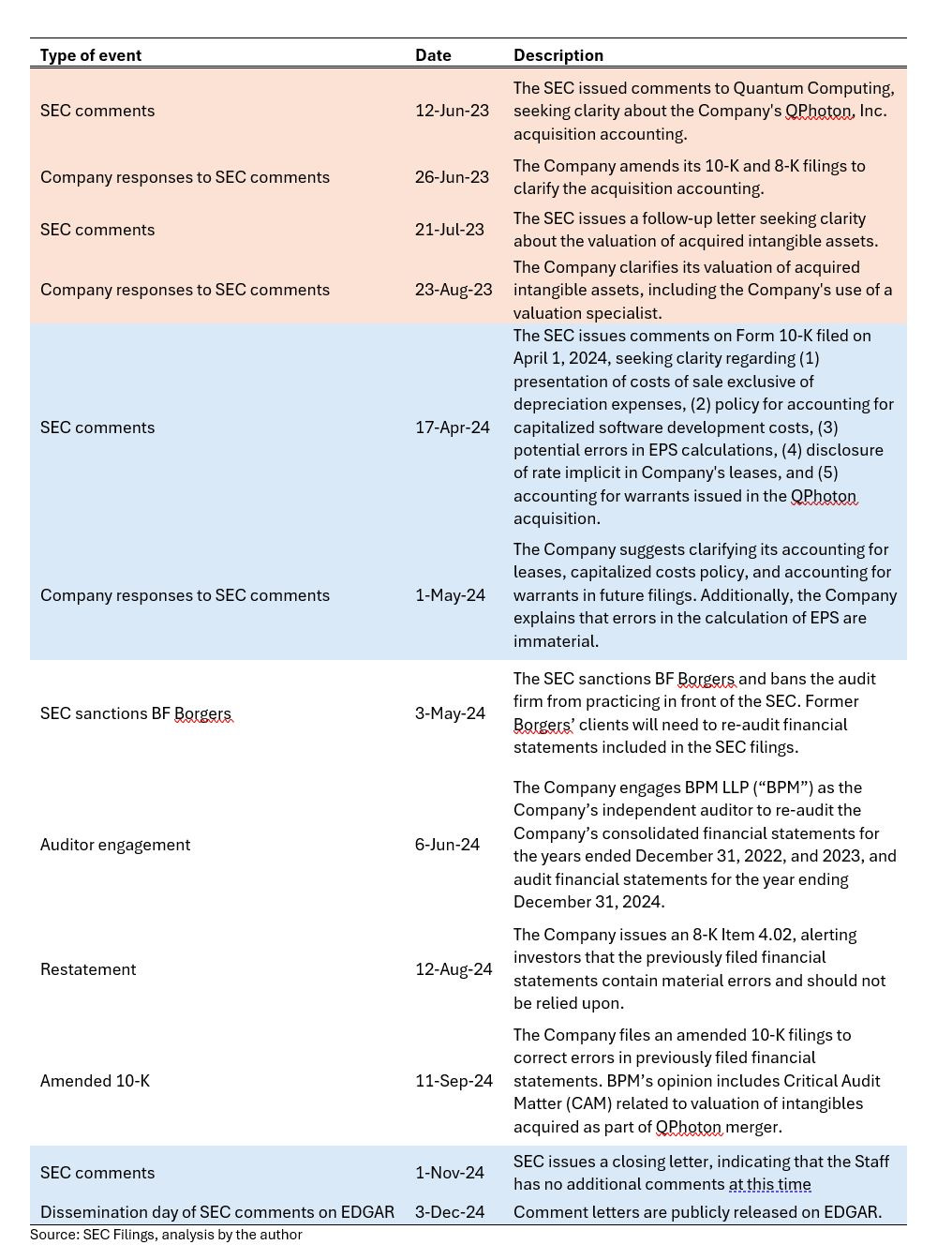

While the first SEC comments were issued on June 12, 2023, the closing letter was issued on November 1, 2024. Say it differently: the review spans over 508 days, at least 5 times longer than a typical SEC review with an average 60 to 90 days duration. (For more discussion about why long SEC reviews could be a red flag, see my Unresolved SEC Comment Letter updates.)

The flow of the conversation was unusual, with a pause of eight months between rounds of the comments, and of six months between the last round of comments and the closing letter. Additionally, on July 23, 2024, Corp Fin asked the Company to clarify the judgment call used by the audit firm in not including a Critical Audit Matter (CAM) for the valuation of intangible assets in the audit opinion. According to the PCAOB, CAMs are audit-related matters that involve especially challenging, subjective, or complex audit judgments:

Source: PCAOB

Importantly, while the auditor must communicate CAMs to the audit committee, CAMs are the auditor’s responsibility, not the issuer’s. While it is not uncommon for the SEC to request that a company ask its audit firm to rectify technical deficiencies in an audit opinion – for instance, adding a missing signature date or correcting the city where the opinion was issued – commenting on CAMs is uncommon for Corp Fin. The audit firm that signed Quantum Computing’s 2022 and 2023 audit opinions was BF Borger – namely, the same audit firm that in May 2024 was sanctioned by the SEC and that the (now former) Director of the SEC’s Division of Enforcement Gurbir S. Grewal called a “sham audit mill.”

According to the SEC’s press release, the SEC charged Borgers with “…deliberate and systemic failures to comply with Public Company Accounting Oversight Board (PCAOB) standards in its audits and reviews incorporated in more than 1,500 SEC filings from January 2021 through June 2023”. Based on the timing of the filings reviewed by the SEC (“through June 2023”), it is likely that the investigation of Borgers' audits commenced around late summer or early fall of 2023.

So, an interesting question: was the unusual structure of the SEC review and CAM-related question at least partially related to the SEC’s investigation of Borgers? For instance, was the the eight months gap between the round of comments at least partially attributable to the SEC’s Corp Fin giving more scrutiny to the Company’s filings because of the Borgers investigation by SEC’s Division of Enforcement already underway at the time of the Corp Fin review?

Note that these are hypothetical questions, not factual statements. Note also that the enforcement action was against the audit firm not any of its client issuers. Moreover, the SEC press release emphasized that BF Borgers deceived its clients by falsely representing that the audit complied with the PCAOB standards and fabricating audit evidence.

Structure of the conversation with the SEC

Let’s look at selected accounting events concerning Quantum Computing that occurred between June 2023 and November 2024 (events related to SEC comments are highlighted).