Red Flags in Amended Annual Reports - Quarterly Update #4

Amended annual reports deserve investor's attention because they often deliver bad news.

Why amended 10-Ks are important?

Businesses frequently submit revised annual 10-K reports to make technical changes, such as filing proxy information or correcting minor typos. These amendments are typically routine and hold little significance for investors.

Nevertheless, some amended reports convey adverse developments, such as uncovering inaccuracies in previously submitted financial statements or reporting deficiencies in internal controls. These revisions warrant scrutiny because the disclosed negative information may be substantial, and the amended filing could serve as the initial source for announcing such developments.

Amended 10-K filings - quarterly update #4

In this quarterly update, I examine the reasons for the 10-K/A amendments filed between July 1, 2024, and September 30, 2024. (Quarterly updates #1, 2, and 3 are available here, here, and here).

Companies filed 147 amended 10-K reports in the September 30, 2024, quarter.

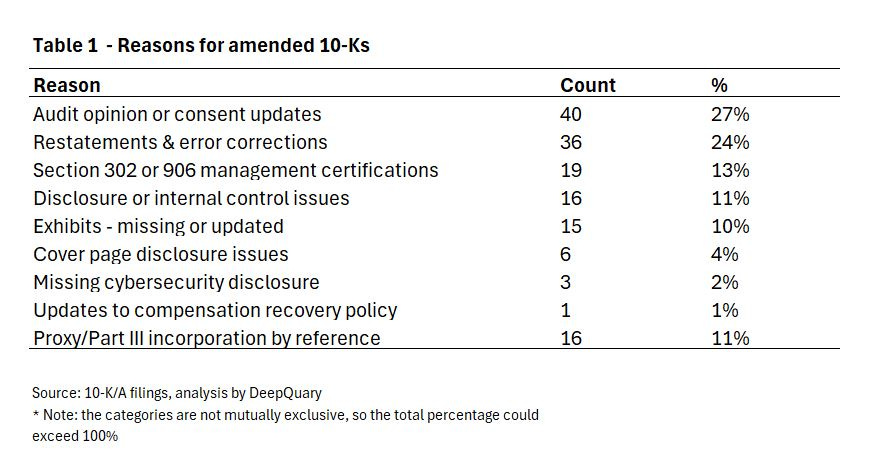

Table 1 below reflects the primary reasons for the amendments.

The discussion of selected categories and filings is below.

(Company-level data underlying quarterly 10-K/A updates is available to premium subscribers.)

Audit opinion or consent updates

In the September 30, 2024, quarter, 40 10-K/As were filed to correct or modify the information contained in audit opinions or auditor’s consents. While most issues involved technical updates, such as correcting the opinion's signature dates or city reference, at least five companies - Shuttle Pharmaceuticals Holdings, Inc. [Ticker: SHPH], Quantum Computing Inc. [Ticker: QUBT], Jet.AI Inc. [Ticker: JTAI], Unusual Machines, Inc. [Ticker: UMAC], Reborn Coffee, Inc. [Ticker: REBN] and General Enterprise Ventures, Inc. [Ticker: GEVI] - filed amended annual reports to replace the opinion of BF Borgers CPA PC and file the re-audited financial statements during the third quarter of 2024.

Five of the former Borgers clients - Shuttle Pharmaceuticals, Quantum Computing, Unusual Machines, Reborn Coffee, and General Enterprise Ventures – restated the previously filed annual or quarterly financial statements following the re-audits.

Shuttle Pharmaceuticals Holdings, Inc. [Ticker: SHPH] corrected errors in calculations of (1) deferred compensation, (2) calculations of fair value of certain warrants, (3) accounting of certain notes payable, and (4) identification of deferred issuance costs incurred in relation to the IPO. The errors more than doubled the previously reported EPS loss for fiscal 2022 of ($2.32), increasing it to an EPS loss of ($5.04). Shuttle Pharmaceutical replaced Borgers in 2023, so only 2022 but not 2023 financial statements were required to be re-audited.

Reborn Coffee, Inc. [Ticker: REBN] reported in its amended annual report filed on July 8, 2024, that the amended report is filed “to provide immaterial amendments to the financial statements of Reborn Coffee, Inc.” and to “replace the Report of Independent Registered Public Accounting Firm of BF Borgers CPA PC (“Borgers”). While the Company did not disclose either the nature or magnitude of the errors, using Calcbench’s revision tool – which compares XBRL-tagged numbers across a series of filings – helps to get a sense of what changed. Calcbench identified 82 revisions in the amended report, including increases in accounts payable and accounts receivable.

Quantum Computing Inc. [Ticker: QUBT] corrected errors related to (1) purchase accounting, (2) calculations of stock-based compensation, (3) valuation of the Series A convertible preferred stock warrants, (4) accounting for debt and equity issuance costs, (5) reserving a collection risk for loans receivable, and (6) the recognition period for certain operating expenses. The error corrections increased the previously reported 2023 EPS loss of ($0.42) by (0.04), or 11%.

Unusual Machines, Inc. [Ticker: UMAC] corrected errors in (1) the classification of certain non-current assets as current on the balance sheet, (2) unrecorded stock compensation of $600,000, and (3) misclassification of deferred offering costs as an operating activity rather than a financing activity on the cash flow statement. The errors increased the previously reported loss of ($0.54) for fiscal 2023 by ($0.18), or about 33%.

General Enterprise Ventures, Inc. [Ticker: GEVI] did not disclose a restatement in the amended annual report. However, the Company filed an amended 10-Q on August 12, 2024, to correct errors in the amortization of intangible assets. The error correction increased the previously reported net loss for the quarter ending March 31, 2023, of $353K by about $62K, or roughly 17.5%.

Notably, issues related to deferred compensation and offering costs appeared to be a recurring theme.

On May 3, 2024, the SEC sanctioned Borgers and banned the audit firm from practicing in front of the SEC. In a separate release, the SEC reminded companies that public Borgers’ clients must engage a new audit firm registered with the PCAOB. Additionally, companies must not include opinions issued by Borgers in the 10K filings or present quarterly financials reviewed by Borgers in the 10-Q reports after May 3, 2024 (the date of the SEC order).

The disclosure of restatements by former Borgers' clients will likely continue for several quarters as more companies engage new auditors and re-file their financial statements. Based on my analysis of data downloaded from the Audit Analytics Auditor Changes database, 142 out of 159 companies that disclosed a resignation of Borgers since May 2024 - or about 89% - have already engaged a new firm. Based on the Audit Analytics restatements database, fifteen of these companies disclosed a restatement. (Note that my analysis does not include cases such as Shuttle Pharmaceutical that dismissed Borgers before the SEC order.)

Let me reiterate a few auditor-related points that I discussed in my previous posts. While hiring a new PCAOB-registered auditor is essential in complying with the SEC’s directive, companies may want to be mindful of the firm they hire. For instance, nine former Borgers clients engaged Olayinka Oyebola & Co. On September 30, 2024, the accounting firm was sanctioned by the SEC for the firm’s role in Tingo’s accounting scandal. The SEC is seeking to permanently ban the firm from auditing U.S. public companies, which means that companies that switched from Borgers to Olayinka would need to seek a new auditor – again. (A list of Olayinka clients with opinions reported on Form AP is available on the PCAOB site.)

Moreover, as I previously discussed, many firms engaged by former Borgers’ clients are small, and bringing in more clients may significantly increase the workload on the engagement teams.

Restatements & error corrections

In the September 30, 2024, quarter, 34 companies filed 36 amended reports to disclose restatements-related information. Based on the check box disclosure on the cover page, 12 companies considered the error corrections a restatement in the context of Rule 10D-1. In three cases, the errors required a compensation recovery analysis.