What Do Numbers Tell Us About Uber's Legal Battles?

Uber and Lyft recently lost a legal battle in New York focused on driver classification. But for some jurisdictions Uber records its litigation costs as if the company thinks it's still winning.

On November 2, 2023, Uber and Lyft settled an allegation of wage theft by the New York Attorney General covering New York state drivers for the two car-hire platforms. The claims were about the companies wrongfully deducting sales taxes and fees from drivers’ pay and denying them employment benefits mandated by New York’s labor law.

As part of the settlement, Uber agreed to pay $290 million, while Lyft settled for $38 million. The companies also agreed to implement a guaranteed minimum payment per ride and provide drivers with paid sick leave, required under New York law. The Attorney General's office highlighted that these settlements would return $328 million in back pay to drivers, establish a minimum driver earnings threshold, and provide drivers with certain required employment benefits such as paid leave.

While the Attorney General’s press release provides an upbeat picture of the benefits to the drivers, Benjamin Black of Deutsche Bank described the New York Attorney General’s settlement as “a nice regulatory win” for Uber.

Notably absent from the Attorney General's statement is any directive to reclassify drivers from independent contractors to employees, a change that would significantly impact both Uber’s and Lyft's business models.

Uber’s earnings release clarified the situation, stating that the agreement with the New York AG establishes new protections and benefits while affirming drivers' status as independent contractors. This settlement indicates that the matter of employment classification is deemed resolved (emphasis added):

“Recent Developments

New York State Attorney General (“AG”) agreement: Reached an agreement with the New York State AG that delivers important new protections and benefits while protecting drivers’ ability to work flexibly as independent contractors. With this agreement, the AG’s office makes it clear that the issue of employment classification is considered settled in New York.”

Analyzing the impact of this settlement from an investor’s perspective, we focused on three aspects: the future impact of additional employment benefits, the classification of drivers, and the financial effect of the $290 million settlement on Uber's legal contingency balance. (Pieces of this analysis primarily discuss Uber's financials, though it would also apply conceptually to Lyft.)

As Francine McKenna reported in MarketWatch in July 2019, changing drivers' classification from contractors to employees would have significant adverse consequences for Uber and Lyft:

“Uber and Lyft’s determination that net revenue is the right way to report under GAAP is also consistent with their legal position that insists drivers are independent contractors and not employees of the companies. If the “drivers are independent contractors” assumption is invalidated in significant markets, both companies admit that the impact on their business model would be “adverse.”

From the accounting perspective, classifying drivers as contractors means that Uber, as an agent, would continue presenting revenue on a “net” basis (gross revenue less the driver expenses). Uber supplements this disclosure with a non-GAAP metric, “Gross Bookings” (defined as the total dollar value of rides, including any applicable taxes, tolls, and fees) in order to provide more information about the total revenue it collects from passengers. In Q3 of 2023, Uber reported $9.3 billion in net revenue compared to $35.3 billion in Gross Bookings.

Changes in paid leave and other benefits policies are anticipated to increase operating costs in significant markets such as New York City, which contributed substantially to Uber's 2022 Mobility Gross Bookings. Under hypothetical conditions of constant prices, the additional costs imposed on Uber would reduce revenue and GAAP net income but Gross Bookings is unaffected. In real life, however, the dynamic is a little more complex. For instance, Uber and Lyft will likely pass the costs on to consumers which may affect demand.

Additionally, since the settlement confirms the current classification of drivers as independent contractors in New York, drivers continue to bear significant self-employment tax burdens, saving Uber and Lyft hundreds of millions annually.

Moreover, according to Uber’s response to Deutsche Bank's Benjamin Black’s question on the earnings call, the New York settlement could provide a framework for the legal resolutions in other states and jurisdictions:

“And for example, our settlement with New York AG and the DOL provides for earners to be able to earn flexibly on the platform with minimum earnings and other protections as well, insurance protections that we think is the right framework going forward. It's the same framework that voters voted for in Prop 22 in California. And if I look big picture, generally, the world is moving toward this model, which is earned flexibly with benefits such as minimum earnings and other benefits out there that are important on a state-by-state basis or on a country-by-country basis. And for us, it's really entering into dialogue with all the constituencies to get to the right solution there.”

Finally, the settlement addresses the wage theft by both companies — the improper deductions of sales tax and other fees, amounting to $290 million for Uber and $38 million for Lyft. Both companies reported that these settlement amounts were fully reserved for as of September 30, 2023. However, their approaches to disclosing the legal complaint and related charges differed slightly.

As discussed in our previous post, ASC 450 allows companies to obfuscate the timing and the amounts reserved for specific settlements because detailed disclosure supposedly would give away confidential competitive information.

Uber's Legal Contingencies - Can SEC Inquiries Add Clarity to "Unprecedented" Legal Charges?

The SEC issued a comment letter to Uber (UBER) on July 23, 2023, requesting additional clarity regarding its inclusion or exclusion of specific charges in its "certain legal, tax, and regulatory reserve changes and settlements" adjustment. Uber used this adjustment to calculate Adjusted EBITDA, a non-GAAP metric. Uber responded that the non-GAAP adjustm…

First, let’s look at Lyft. Based on our analysis of the contingencies footnotes in 2022 and 2023 10-Q and 10-K filings, Lyft first disclosed specifics of the New York Attorney General allegations in Q2 of 2023:

“The New York Attorney General has alleged misrepresentations related to certain fees and related driver pay deductions, as well as misclassification of drivers and related labor law violations in New York. The Company has reached an agreement in principle to resolve this matter. The amount accrued for these matters is recorded within accrued and other current liabilities on the consolidated balance sheets as of June 30, 2023.”

The disclosure noted that the company agreed in principle to resolve the matter, suggesting that as of June 30, 2023, the negotiations were underway for a while. Lyft’s blog dated November 1, 2023, mentioned that the company accrued for the settlement in Q2 of 2023, foreseeing no future impact on their P&L:

“Financial Disclosure: As we accrued for this agreement in Q2 of 2023, we do not expect a material impact on our P&L from this event. We expect to make a payment of approximately $20 million in Q4 of 2023, while the remainder will be paid in 23 monthly installments.”

Uber, on the other hand, disclosed the New York Attorney General’s allegations earlier, in the annual 10-K report filed on February 21, 2023:

“New York Attorney General

The New York Attorney General has alleged misclassification of drivers and related employment violations in New York by Uber as well as fraud related to certain deductions. The ultimate resolution of this matter is uncertain and the amount accrued for those matters is recorded within accrued and other current liabilities on the consolidated balance sheets as of December 31, 2022.”

In Q1 of 2023, the company disclosed that “Uber is in advanced discussions with the office regarding resolution of the matter”. In Q2 of 2023, the disclosure was updated again to state that the company “reached an agreement in principle” to resolve the matter – the language similar to that used by Lyft to describe the case. In Q3 of 2023, Uber updated the language yet again to note that the company “reached the agreement to resolve this matter”.

While Uber disclosed the litigation as early as February 2023, the timing of its contingency accrual is unclear. Can we exploit SEC comment letters and non-GAAP disclosure to solve the timing of the contingencies puzzle?

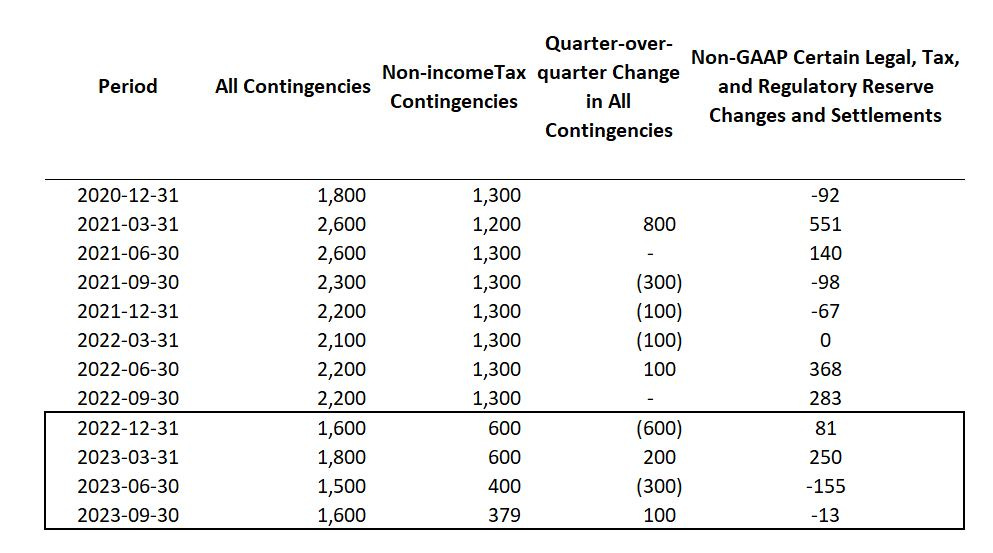

We again used Calcbench’s XBRL page to collect Uber’s contingencies data. The non-GAAP information was collected from 8-K filings:

Table 1 – Uber’s Legal Contingencies and non-GAAP Legal, Tax, and Regulatory Reserve Disclosure, million $:

Uber adjusts non-GAAP numbers to remove legal, tax and regulatory settlements that it says are non-routine – or, as Uber described it, matters with “limited precedent”. Assuming the New York Attorney General’s allegations were one of the non-ordinary legal and regulatory cases described in Uber’s response to prior SEC inquiries, the contingency-related charges would appear as a reconciling adjustment to calculate the non-GAAP Adjusted EBITDA (last column in the table above). We believe this assumption is reasonable because the settlement concerned drivers’ classification issues, but this analysis would not apply if the matters involving wages theft allegations are classified as ordinary by Uber.

Importantly, non-GAAP legal adjustments are reported on a net basis – namely, legal charges less reversals. From the accounting perspective, reversals are recorded when previously estimated litigation losses turned out to be less than expected or as a result of winning a legal case and being able to reverse an accrual completely. That's because unlike losses that are required to be estimated to the extent possible, gains are recorded only when real, that is when realized.

The analysis of Uber’s non-GAAP data shows a net legal gain (reversal) of $155 million in the quarter ended June 30, 2023. If, like Lyft, Uber recorded the entire $290 million settlement amount in Q2 of 2023, it would mean that the “gross” legal gain - a reversal before adding the charge of $290 million - was in excess of $400 million.

While it is possible for Uber to record a reversal or a gain of such a magnitude, it is also possible that the $290 million charge was recorded in a different period. ASC 450 states that companies need to accrue legal liabilities if the amount is both probable and reasonably estimable. Would the “advanced discussions” reported in Q1 of 2023 provide sufficient ground to record the accrual as early as in the quarter ending March 31, 2023? Or was the entire amount accrued at December 31, 2022 - the same quarter the legal case was disclosed by Uber in the 10-K filing? We do not have sufficient information to say with certainty. Still, we think investors can exploit parity in Uber’s and Lyft’s disclosures to gain insight into material legal charges.

In addition to these settlements, Uber faced a VAT-related assessment of $622 million imposed by the UK Tax Authority, consisting of $487 and $135 million imposed in June and September of 2023, respectively. Uber disclosed that the aggregate $622 million payment is currently recorded as receivable, because they are expecting a full refund when Uber wins the appeal.

From the 10-Q filing for the quarter ended September 30, 2023 (emphasis added):

“As of March 14, 2022, we modified our operating model in the UK, such that as of that date Uber UK is a merchant of transportation and is required to remit VAT. Uber UK is remitting VAT under the Value Added (Tour Operators) Order 1987 (“VAT Order 1987”), which allows for VAT remittance on a calculated margin, rather than on Gross Bookings.

In June 2023, we received an assessment from the UK Tax Authorities (“HMRC”) that disputed our application of VAT Order 1987 application for the period of March 2022 to March 2023 and included an assessment of £386 million (approximately $487 million) for unpaid VAT. In July 2023, we paid the assessment in order to proceed with the appeals process. In September 2023, the HMRC updated the assessment and we paid an additional £107 million (approximately $135 million). The payments do not represent our acceptance of the assessments. The payments are recorded as a receivable because we believe that we will be successful in our appeal, upon which, the full amount of our payments will be returned to us with interest upon completion of the appeals process. We expect to receive additional assessments related to prior or future periods, which we will be required to pay in order to continue with the appeals process. Any payments are expected to decrease operating cash flow and have no impact on our results of operations. We plan to vigorously defend our application of the VAT Order 1987 and are waiting to obtain hearing dates from the Tax Tribunal.”

The disclosure is notable for several reasons. First, as Francine McKenna noted in Market Watch article, the dispute underscores the connection between the legal position, business model, and accounting. Changes in drivers’ classification in the UK led to changes in business model, to the dispute related to VAT assessment, and to a corresponding choice response by selecting an accounting method that mitigated the impact.

Second, it manifests a reversal of Uber’s position, disclosed until Q1 2023, that the company cannot estimate losses. From the Q1 filing:

“As part of our ongoing discussions with HMRC, they have indicated that they are reviewing our VAT filings. The HMRC may disagree with our application of VAT Order 1987, but due to the complexity and uncertainty of these matters and the judicial processes, any reasonably possible loss or range of loss cannot be estimated.”

The disclosure above is consistent with ASC 450 that permits companies to delay accruals if the loss cannot be reasonably estimated.

However, in Q2, after receiving the initial $487 million VAT assessment, Uber changed the language that describes the estimated losses and stated its expectation to record the payment of the assessed amount as account receivable – without impact on P&L:

“We expect to record this payment as a receivable because we believe that we will be successful in our appeal, upon which, the full amount of our payment will be returned to us with interest upon completion of the appeals process. It is possible that we will receive additional assessments related to prior or future periods, which we will be required to pay in order to continue with the appeals process. Any payments are expected to decrease operating cash flow and have no impact on our results of operations. We plan to vigorously defend our application of the VAT Order 1987 and are waiting to obtain hearing dates from the Tax Tribunal “

In Q3 of 2023, the expectation turned into certainty - Uber paid the total $622 million VAT assessment and recorded a receivable.

Contrasting the Q1 and Q2 disclosures, in Q1 Uber did not record an accrual because the company did not know how much to reserve. However, in Q2 Uber did not record an accrual because the company believed they did not need to reserve – saying it differently, because their estimate of the expected loses that have already been paid, and where additional taxes will be paid, is aggressive. It would be like refunding a customer for goods but recording a receivable based on the idea you were going to sue to get them to pay for the goods again somehow.

Our interpretation of Uber’s disclosure is based on publicly available information which can take us only so far. Uber’s updated belief related to the dispute with the UK Tax Authorities could be prompted by new information received by the company during the second quarter – for instance, a new legal or tax opinion that supports their position. However, there is no certainty about the receipt of or the timing of any refund. The date of the Tax Tribunal hearing has not been set.

If Uber loses the appeal, Uber will have to write-off and expense the uncollectable portion of the receivable, which, in case of the lost dispute, would likely be material. As of September 30, 2023, Uber’s accounts receivable balance includes $622 million (more than 20% of the total balance) of non-operational receivables. Considering the materiality of the receivable, we would expect Uber to update the account receivable footnote in the upcoming 10-K filing if the issue is still outstanding as of December 31, 2023.