Archer-Daniels-Midland (ADM) cuts executive pay amid accounting investigations

How Archer-Daniels-Midland’s Board addressed compensation in light of internal investigation and regulatory probes

On March 25, 2025, Archer-Daniels-Midland Co. (Ticker: ADM) disclosed in its proxy statement that the Company exercised “negative discretion” and reduced the 2024 bonuses of certain executive officers (emphasis added):

“Exercise of Negative Discretion—In connection with the 2024 compensation decisions, the Compensation and Succession Committee and the Board believed it was appropriate to consider the impact of the ongoing investigation regarding certain accounting practices and procedures with respect to ADM’s Nutrition reporting segment (the “Investigation”). Although no named executive officer of the Company has been found to have engaged in improper conduct, to ensure accountability and clarity of our priorities, the Board determined that it was appropriate for the Compensation and Succession Committee to exercise negative discretion to reduce the payout percentage under the Company performance component of the 2024 annual cash incentive program and the shares earned for the 2022 PSUs for select participants. This negative discretion was applied to certain NEOs who were in relevant leadership positions during the period covered by the Investigation. The reductions, described in more detail in the “2024 Annual Cash Incentive” and “Equity-Based Long-Term Incentives” below, are part of the Company’s broader efforts to demonstrate accountability at an institutional level.”

The discretion applied by the Compensation Committee led to cutting in half the earned number of shares of certain executives and completely eliminating the number of shares earned by one executive officer (emphasis added):

“However, as discussed in “Key Executive Compensation Actions For 2024,” the Compensation and Succession Committee exercised negative discretion to reduce the number of shares earned by half for certain NEOs and to zero for one NEO, who in each case were in relevant leadership positions during the period covered by the Investigation.”

According to the Archer-Daniels-Midland SEC filing, the Audit Committee’s internal investigation, which was disclosed in January 2024, identified a misreporting in intersegment accounting. The Company also has a regulatory probe related to the same issue:

“Government Investigations

As previously disclosed, the Company is under investigation by the United States Securities and Exchange Commission (“SEC”) and the Department of Justice (“DOJ”) relating to, among other things, intersegment sales between the Company’s Nutrition reporting segment and the Company’s Ag Services and Oilseeds and Carbohydrate Solutions reporting segments. The Company is continuing to cooperate with the SEC and DOJ investigations and is unable to predict the outcome of these investigations.”

In 2024, Archers-Daniels-Midland disclosed little r and Big R restatements related to intersegment accounting and responded to SEC inquiries, which cited SEC’s objection to the characterization of errors as immaterial. (My previous pieces that dig into Archer-Daniels-Midland’s restatements are available here, here, and here.)

While SEC rules require companies to recover erroneously awarded compensation following both Big R and little r restatements, there was no erroneously paid compensation to recover, according to the Company:

“As previously disclosed, during 2024, the Company amended its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and its Quarterly Reports on Form 10-Qs for the first and second quarters of 2024, to restate the segment information disclosure for each of the periods included in those filings. In accordance with the Clawback Policy, the Compensation and Succession Committee evaluated whether there was any erroneously awarded compensation subject to recovery under the Clawback Policy. The Compensation and Succession Committee concluded that there was no erroneously awarded compensation requiring recovery under the Clawback Policy, because the restated amounts did not impact the achievement of any financial reporting measure used in determining incentive-based compensation of the covered executives for awards received by covered executive officers during the applicable lookback period.”

Say it differently: the errors in intersegment sales did not affect the consolidated financial metrics, such as ROIC, used to determine the performance-based compensation, so the compensation payouts are unaffected.

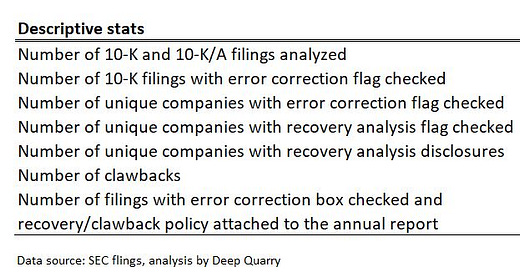

According to my review of SEC Rule 10D-1 disclosures, only two companies recouped erroneously awarded compensation in 2024. Moreover, more than half of the 30 recovery analysis disclosures examined cited unaffected payout metrics as a reason for not requesting the compensation back.

According to a recent study by compensation consultant Ted Jarvis, all 30 Dow 30 companies have recoupment policies that extend beyond those imposed by the SEC clawback rule. While Archer-Midland-Daniel’s policy also allows forfeitures and clawbacks for a wide range of issues, including a termination for cause or prohibited conduct, these provisions are not required by law, and the Company has a broad discretion in how to apply them.

It begs a question: why would a company voluntarily invoke a clawback provision – especially since, according to the Company, no named executive officer (NEO) was engaged in improper conduct?