ADM’s (Ticker: ADM) immaterial accounting errors draw SEC scrutiny, leading to a material restatement

SEC comments push Archer-Daniels-Midland to reclassify errors, leading to material restatement

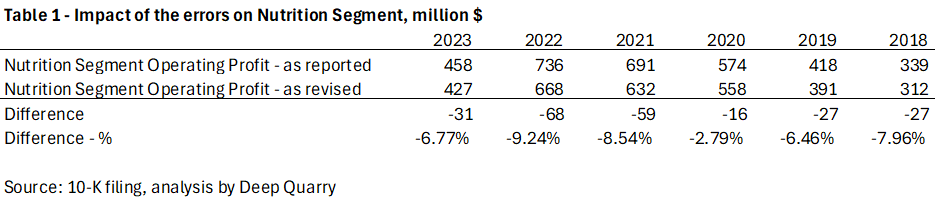

In its annual 10-K filed on March 12, 2024, Archer-Daniels-Midland Co. (Ticker: ADM) disclosed that the Company identified immaterial accounting errors in intersegment sales. According to the Company, the errors were discovered following the SEC's June 30, 2023 inquiry. In my March 19, 2024, post, I outlined the considerations that could be applicable in accessing the materiality in ADM’s case and wondered how the characterization of errors as immaterial revisions aligns with the regulatory investigations and putting the CFO on administrative leave.

I was not the only person intrigued by the ADM’s immateriality considerations. On May 22, 2024, the SEC issued comments to Archer-Daniels-Midland Co, seeking clarity about the Company’s decision to classify certain segment-specific financial errors as revisions rather than restatements, requesting justification under ASC 250-10-50-7 and a materiality analysis per SAB Topic 1:M and 1:N.

In response, the Company explained that the errors—stemming from intersegment sales and revenue misclassifications—were immaterial disclosure-only errors and had no impact on consolidated financial statements, per-share amounts, or equity. According to the Company, while ASC 250-10-50-7 was deemed inapplicable to immaterial errors, the Company voluntarily disclosed detailed adjustments in Note 17 of its 10-K for transparency.

On November 1, 2024 – almost six months after the initial letter - the SEC issued follow-up comments and, in no vague terms, stated that SEC staff disagreed with the Company’s materiality conclusion (emphasis added):

“We have considered your responses to our prior comment number 4 in our letter dated May 22, 2024. Based on the representations of the Company, we do not agree with your method of correction for errors in certain segment financial information since we believe these errors are material to the Company’s previously issued financial statements. Please amend your previously filed Form 10-K for the fiscal year ended December 31, 2023, and subsequently filed Forms 10-Q to restate your consolidated financial statements to correct the identified errors and provide the disclosures required by ASC 250-10-50. As part of your amendments, please revisit your controls and procedures evaluation to determine whether any additional control deficiencies exist and whether there has been any change in the assessed severity of control deficiencies that have already been identified.”

The Company concurred with the SEC and filed an 8-K Item 4.02 Non-Reliance filing on November 5 to alert investors that the previously filed financial statements cannot be relied upon.

The materiality analysis was filed under a separate cover under a confidential treatment request and is, therefore, not public. However, we can use the public portion of the Company’s response, SEC speeches, and accounting rules to conjecture why the SEC was not convinced by Archer-Daniels-Midland Co.’s justification for classifying the segment-specific financial errors as an immaterial revision rather than restatement.

Let’s look at an excerpt from the Company’s response to the SEC that characterizes the errors as immaterial voluntary revisions (emphasis added):

“As explained further below, the Company concluded that these were immaterial disclosure errors, and the retrospective correction thereof in the 10-K was viewed as a voluntary revision of an immaterial disclosure error.”

However, the SEC views segment disclosures as potentially material, even if they do not affect consolidated figures. For instance, during the 2024 AICPA conference on the SEC and PCAOB developments, the SEC OCA staff observed that disclosure-only errors, such as segment reporting corrections, could be material. According to SEC Staff, companies should apply qualitative and quantitative considerations to determine the materiality of footnote errors. Thus, the SEC was unlikely to find the argument that the disclosure-only errors are, by default, immaterial, persuasive.

Additionally, the term “voluntary” in the Company’s response to the SEC implies that the errors were so immaterial that the Company did not have to revise the previously filed financial statements. Say it differently: if the errors were left uncorrected, the aggregate impact would not be material to the current period financial statements.

Let’s look at the Company’s 10-K disclosure that outlines the impact of the errors: