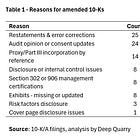

SEC Compensation Recovery Rule: Restatements and Related Clawbacks, Quarterly Update # 3

A quarterly review of compliance trends, SEC comment letters, and the complexities of recovery analysis

SEC Rule 10D-1 – often referred to as the compensation clawback rule - requires public companies to adopt policies to recover excess incentive pay that was paid to current or former executives because it was based on metrics that were later restated. Created under the Dodd-Frank Act, the rule aims to reinforce accountability by requiring the recoupment of bonus or performance-based compensation tied to incorrect results, regardless of whether the error was caused by simple mistakes or misconduct. It applies to both material (“Big R”) and immaterial (“little r”) restatements.

The rule also adds disclosure requirements: companies have to flag on the cover page of their annual reports when the filing reflects corrections to past financial statements, explain whether and how they pursued recovery of excess compensation, and include their clawback policy as an exhibit to the annual report.

Key Q3 2025 findings:

The Q3 2025 pattern continued what I observed in Q2 2025: companies are still encountering many of the same implementation frictions we saw in 2024 and early 2025, although there are modest signs that disclosure and policy compliance are moving in the right direction.

The number of error correction flags declined sharply, with 22 companies in Q3 2025 compared to 33 in Q3 2024 checking the error correction box.

The number of recovery analysis flags declined in the third quarter of 2025, with 6 recovery analysis flags in Q3 2025 compared to 11 in Q3 2024.

The number of recovery analysis disclosures in Q3 2025 was comparable to that in Q3 2024, with 8 and 7 disclosures, respectively.

Companies did not disclose new compensation clawbacks; however, two companies indicated that the recovery analysis is still ongoing as of Q3 2025.

The figure below describes the number of companies with error-related flags in the third quarter of 2025.

Figure 1 – Companies with error correction and recovery analysis boxes selected

Source: SEC filings, analysis by Deep Quarry.

(Note: company-level data underlying Figure 1 is available for premium subscribers of Deep Quarry.)

Companies checking the error-correction box fell from 33 filers in Q3 2024 to 22 in Q3 2025. This pullback could reflect a couple of patterns:

The 2024 spike tied to Borgers-related restatements has largely subsided by late 2025, resulting in fewer restatements being reported in 2025. With that in mind, most Borgers-related restatements were disclosed in Q4 2024, so Borgers-related restatements alone are unlikely to explain the year-over-year decrease in the number of restatements.

Some corrections may appear in filings that don’t trigger the Rule 10D-1 cover-page indicators. For example, an increase in error corrections first disclosed in 10-Qs instead of 10-Ks would make the Q3 2025 count appear lower.

Similar to Q2 2025, a large proportion of companies – 16 out of 22, or approximately 72% - did not check the recovery analysis box in Q3 2025. For comparison, 20 out of 40 companies – approximately 50% - did not check the recovery analysis box in Q2 2025.

Restatements and revisions (Big R and little r) with an unchecked error corrections box

Under Rule 10D-1, companies are expected to check the error-correction box when a 10-K includes restated annual financial statements or footnotes that correct an accounting error. That requirement, however, doesn’t extend to corrections that only affect interim periods or to out-of-period adjustments recorded cumulatively in the current quarter. So, it’s reasonable to infer that some amended 10-Ks showing restatements but leaving the box blank were addressing issues that fall outside the rule’s scope.

From reviewing 10-K/A filings, I’ve identified companies leaving the checkbox blank when the corrections were disclosure-focused and didn’t change the numbers — for example, refining a segment disclosure to better describe the CODM metric under ASC 280 - or when the change was clearly clerical. But there were also instances where filers didn’t check the box for what looked like “little r” corrections (such as cash flow classification errors), presumably because they determined - correctly or not - that Rule 10D-1 wasn’t triggered.

Specific examples are available for paid subscribers after the paywall in my amended 10-K filings analysis.

Company-level data underlying the quarterly amended 10-K analysis is available for premium subscribers of Deep Quarry.

Out-of-period adjustments

As I’ve noted before, the criteria companies use to sort errors into Big R, little r, and out-of-period adjustment buckets aren’t public, and the CAR (2021) paper by Choudhary, Merkley, and Schipper shows there is an overlap in the net income effects of those categories.

“However, Choudhary, Merkley, and Schipper (CAR, 2021) finds an overlap in the net income effect of different error correction categories. Will companies use judgment calls to correct borderline cases as out-of-period adjustments, or will awareness of disclosure requirements prompt more transparency with little r revisions? Understanding managerial discretion is important - especially when it bears on executive compensation.”

That overlap gives managers some room to exercise judgment in borderline cases — and the Rule 10D-1 makes that judgment more consequential. When a formal restatement or revision can trigger a clawback analysis, executives and boards may have a stronger incentive to treat a fix as an out-of-period adjustment instead of a little r revision, because the former is less likely to raise “was compensation wrongly paid?” questions. That said, even out-of-period adjustments can still be costly if, in the aggregate, they dent earnings and cause the company to miss an EPS target, so the choice isn’t cost-free.