What can accounting tell us about Microsoft's partnership with OpenAI?

The departure of Sam Altman as the CEO of OpenAI has all the elements of a good drama – a charismatic main character, unexpected plot twists, and a seemingly final act that includes the reinstatement of Altman as a CEO. It is not surprising that OpenAI and what's been called by many one of its leading investors, Microsoft, received unrelenting breaking news treatment throughout the saga – after all, generative AI is expected to change the world.

What is surprising, however, is how little we know about Microsoft's reported $10 billion investment in OpenAI from official sources.

Here is what do we know from Microsoft, based on its official January 23, 2023, press release announcing its most recent round of investment:

“Supercomputing at scale – Microsoft will increase our investments in the development and deployment of specialized supercomputing systems to accelerate OpenAI’s groundbreaking independent AI research. We will also continue to build out Azure’s leading AI infrastructure to help customers build and deploy their AI applications on a global scale.

New AI-powered experiences – Microsoft will deploy OpenAI’s models across our consumer and enterprise products and introduce new categories of digital experiences built on OpenAI’s technology. This includes Microsoft’s Azure OpenAI Service, which empowers developers to build cutting-edge AI applications through direct access to OpenAI models backed by Azure’s trusted, enterprise-grade capabilities and AI-optimized infrastructure and tools.

Exclusive cloud provider – As OpenAI’s exclusive cloud provider, Azure will power all OpenAI workloads across research, products and API services.”

Notice how all of the "investment" activity described is inward facing. Microsoft says it will increase its investment in specialized supercomputing systems, will build out Azure infrastructure, will deploy OpenAI models in its own products, and will continue to sell Azure to OpenAI as its customer. Microsoft will integrate OpenAI technology with its new line of Microsoft’s products, and OpenAI is going to use Azure as its exclusive cloud provider.

Notably absent from Microsoft's official press release is any mention of a specific purchase of shares in OpenAI or any terms of the deal, i.e. the size of any outward-facing investment in OpenAI the company or how much, if any, of the investment came as a direct cash injection.

All of the quantitative terms of the deal — a $10 billion investment round, a 49% Microsoft ownership of OpenAI, and that a substantial portion of the investment is a long-term non-cash commitment for Azure cloud computing credits — were reported by the press, and the press alone, using the anonymous source reference of "people familiar with the matter".

If you go back to the first Microsoft press release, the one issued after a reported $1 billion investment round in July 2019, you will find that the announcement was also short on specifics. In contrast to January 2023, OpenAI co-founder Greg Brockman provided the detailed update to the press.

From TechCrunch on July 22, 2019:

“Update (11:30am PT): long after the press releases hit the wire at 6am this morning, OpenAI contacted us with a bit more detail about the announcement. Here is the statement we received from OpenAI co-founder and CTO Greg Brockman: 'It’s a cash investment into OpenAI LP. It uses a standard capital commitment structure, to be called as we need it. We plan to spend it in less than five years, and possibly much sooner.”

The unexpected firing of Sam Altman on November 17, 2023, prompted more than one question about the actual structure of the deal. For instance, Microsoft announced three days later on November 20, 2023, that it would hire Altman. How could Microsoft hire Altman and, potentially the entire OpenAI team, if there were routine non-disclosure or non-solicitation clauses? Did the agreement include contingencies allowing Microsoft to delay or withhold advancement of any funds and cloud credits to OpenAI, as some media reports appear to suggest? Microsoft neither confirmed nor disputed more detailed media reports, and never publicly elaborated on the structure or terms of the deal.

For the sake of the argument, let’s assume that the agreement details reported by media articles are accurate. Since Microsoft is a public company that has to follow U.S. securities laws about accounting and disclosure of equity investments, can those accounting and disclosure rules help us understand how the deal may be structured?

Let's start with disclosure requirements.

Item 601 of the SEC's Regulation S-K under the Securities Act of 1933 mandates that registrants file all material agreements.

“If a material contract or plan of acquisition, reorganization, arrangement, liquidation or succession is executed or becomes effective during the reporting period reflected by a Form 10–Q or Form 10–K, it shall be filed as an exhibit to the Form 10–Q or Form 10–K filed for the corresponding period.”

If OpenAI was a public company, a reported $10 billion, 49% multi-year partnership agreement with Microsoft would likely be considered material and would have to be filed as an exhibit to a 10-Q or 10-K filing. Portions of the agreement would likely be redacted to avoid disclosing information that could cause competitive harm, but the filed agreement would confirm or clarify portions of what has been reported. However, since OpenAI is a private company, it is not subject to SEC reporting obligations.

But what about Microsoft, which is a public company? The financial impact of the agreement impact is unlikely to be quantitatively material to Microsoft’s revenue — 198 billion in fiscal 2022 — or net income — nearly 73 billion in the same period. However, compliance with Item 601 of Regulation S-K does not generally rest on meeting a quantitative threshold. When determining if you should disclose a material agreement, Reg S-K defines materiality as:

“... the information required to those matters as to which an average prudent investor ought reasonably to be informed before buying or selling any security of the particular company.”

No one can deny that investors are very interested in what Microsfot has repeatedly called a "partnership agreement" with OpenAI. That's because it is instrumental in supporting the development of a promising new line of Microsoft products.

As Satya Nadella stated on Microsoft’s October 23, 2023, earnings call:

“We are off to a strong start to the fiscal year driven by the continued strength of Microsoft Cloud, which surpassed $31.8 billion in quarterly revenue, up 24%. With Copilots, we are making the age of AI real for people and businesses everywhere. We are rapidly infusing AI across every layer of the tech stack and for every role of business process to drive productivity gains for our customers.”

On the call, Microsoft mentioned AI more than 50 times. So, is the partnership agreement with OpenAI material in the context of Item 601 of Reg S-K? Is Microsoft required to file the agreement with the SEC so everyone can see it? I do not know the answer.

Next, let’s consider the reported 49% ownership figure – which, as stated above, was never confirmed or denied by Microsoft. According to Generally Accepted Accounting Principles, GAAP, a minority equity interest of 20% to 49% requires the investing company to use the equity method accounting and generally implies that the investor can exercise a significant influence over the investee.

“ASC 323-10-15-6 provides a list of indicators that investors should consider when evaluating whether or not it has the ability to exercise significant influence over the operating and financial policies of an investee.

Ability to exercise significant influence over operating and financial policies of an investee may be indicated in several ways, including the following:

a. Representation on the board of directors

b. Participation in policy-making processes

c. Material intra-entity transactions

d. Interchange of managerial personnel

e. Technological dependency

f. Extent of ownership by an investor in relation to the concentration of other shareholdings (but substantial or majority ownership of the voting stock of an investee by another investor does not necessarily preclude the ability to exercise significant influence by the investor).

The list of factors in ASC 323-10-15-6 is not all-inclusive, and the determination of whether other factors provide an investor with the ability to exercise significant influence over the financial and operating policies of an investee requires significant judgment and consideration of all relevant facts and circumstances.”

Although Microsoft does not have a seat on OpenAI’s board, Azure is the OpenAI’s “exclusive cloud provider” and “will power all OpenAI workloads across research, products and API services”. These conditions arguably lead to vendor lock and technological dependency and could give rise to cloud-related related party transactions if Microsoft is a minority investor in OpenAI.

Let’s assume that an investment in the 20-49% range has been recorded as an equity method investment – again, this is an assumption, not a factual statement. Here is how Microsoft would account for it, based on how Microsoft describes its equity method accounting policy:

“Equity investments with readily determinable fair values are measured at fair value. Equity investments without readily determinable fair values are measured using the equity method or measured at cost with adjustments for observable changes in price or impairments (referred to as the measurement alternative). We perform a qualitative assessment on a periodic basis and recognize an impairment if there are sufficient indicators that the fair value of the investment is less than carrying value. Changes in value are recorded in other income (expense), net.”

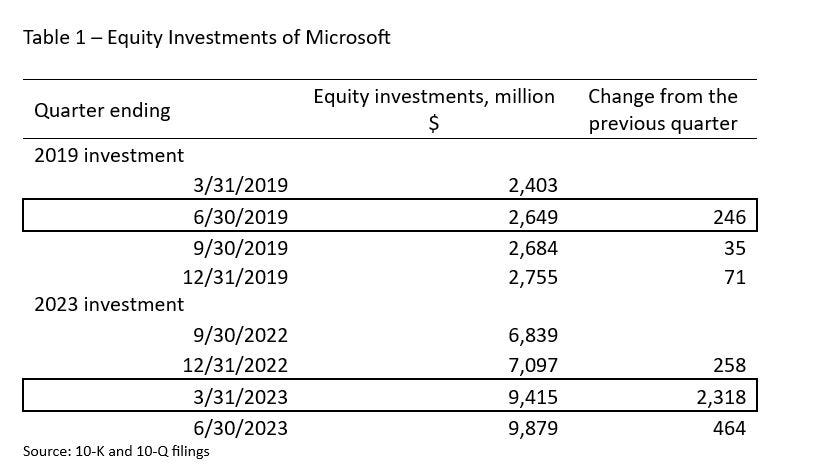

We can review the balances of Microsoft's equity investments for several quarters around the July 2019 "investment" date (reportedly the phase one investment) and near January 2023 (the most recent round of investment). If the 2019 investment was made in July 2019, it would likely be reflected for the first time on the balance sheet as of September 30, 2019. Similarly, if the 2023 investment was made in January 2023, it should be observable on the March 30, 2023, balance sheet.

We can see an uptick of $246 million and $2,318 million in equity investments in the quarters ending June 30, 2019, and March 31, 2023, respectively. I would highlight that the total equity investments as of March 31, 2023 – likely to also include non-OpenAI investments – totaled $9.4 billion, less than the $10 billion Microsoft investment in OpenAI reported by the media.

Why would that be the case? It is hard to say without knowing the terms and structure of the transaction. Perhaps Microsoft does not record the OpenAI investment as an equity investment, or perhaps the transaction was structured on a staggered commitment basis, so only part of the investment would be recorded as of March 31, 2023. Or perhaps there is another reason.

Finally, let’s look at the disclosure requirement while assuming Microsoft does have an equity investment in OpenAI and can exercise significant influence. That raises the question of whether Microsoft and OpenAI have created a related party transaction that must also be disclosed.

From PwC’s accounting guide:

“Section 26.5.1 Disclosure of related party equity method investments

Equity method investees are, by definition, related parties of the equity holder…”

In addition, ASC 850-10-50-1 mandates that a related party disclosure should include the following:

“A description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statement”.

To summarize, since equity method investees of Microsoft are related parties, OpenAI's customer relationship with Microsoft creates a requirement for disclosure of those material related-party transactions. So far, Microsoft has not provided OpenAI-specific related party disclosure – either because Microsoft does not consider OpenAI a related party or because there were no reportable transactions that would be material for Microsoft.