SEC comment letters, auditor changes, and Tesla's accounting tweaks

A departure from the usual deep dive to spotlight emerging trends in SEC comment letters, red flags in auditor resignations, and Tesla's accounting changes

I want to deviate from my standard concept of writing a longer, in-depth, data-driven piece about a particular company or trend and instead highlight several topics and discussions that have drawn my attention over the past several weeks. More specifically –

A decline in the number of SEC comment letters released in the first four months of 2025 compared to the first four months of 2024;

Several auditor resignations that raise a red flag;

A puzzling change in Tesla’s 2024 quarterly results from the previously reported numbers.

Trends in SEC comment letters

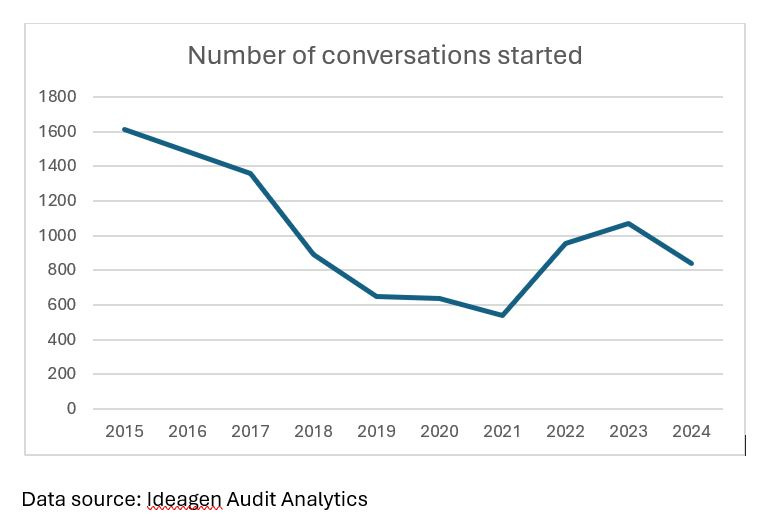

Trends in SEC comment letters are important because they highlight areas where the disclosure is unclear and can be improved and because they reflect the agency’s priorities, helping companies anticipate areas of regulatory scrutiny. Over the past decade, the total number of SEC comment letter conversations referencing periodic filings has generally declined, with a peak in 2015 and a low in 2021, followed by a brief rebound through 2022 before declining again in 2024, according to a report by Ideagen Audit Analytics.

The decline in SEC comment letter conversations between 2016 and 2020 coincided with the first Trump administration, a period marked by a regulatory rollback agenda that prioritized the capital formation. Given the current administration’s emphasis on deregulation and a sharp reduction in workforce, we are likely to see a similar or even sharper decline in the SEC Corp Fin’s comment letters activity. SEC workforce declined by more than 12% in 2025 amid voluntary buyouts, while Corp Fin’s headcount shrunk by a more modest 8.7%, according to Reuters.

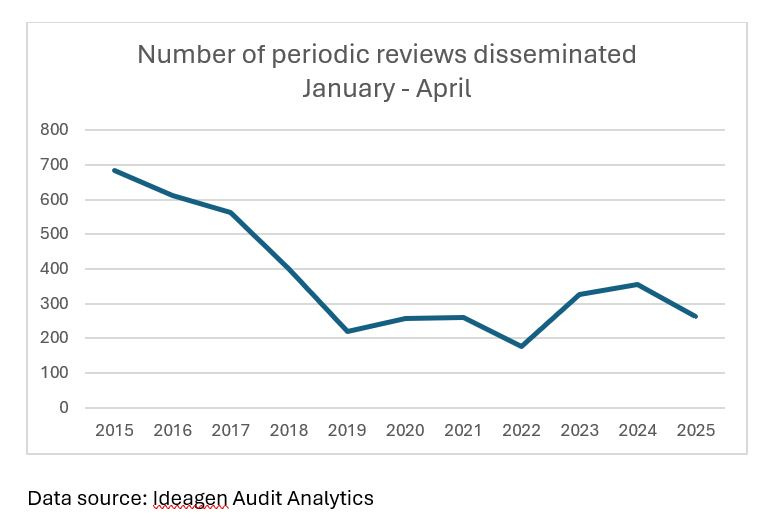

Let’s look at the early data. For this analysis, I look at the number of conversations with a closing letter as a proxy for SEC reviews of periodic filings publicly released on EDGAR in the first four months of each year. SEC comment letters are released about a month after the completion of the SEC review. Thus, a better methodology for an early trends analysis is to examine the number of conversations publicly released on EDGAR during a given period. Looking at the number of conversations started may understate the 2025 results because not all the letters have been publicly disseminated yet.

Based on my analysis of the Audit Analytics data, 263 SEC reviews of periodic filings were released on EDGAR between January and April 2025 – a decline of 20% and 26% compared to the first four months of 2023 and 2024, respectively. However, it is unclear whether the decrease compared to the 2023-2024 level reflects a shift in SEC priorities or if this is merely a mechanical decline related to a lower number of reviews initiated in the second half of 2024. The former explanation implies that the number of reviews is likely to revert to the 2020-2021 level, while the latter suggests we may see an even sharper decline on a full-year basis.

Auditor resignations that raise a red flag – disagreements over accounting matters

Adverse audit opinions, namely those that state the financial statements are not presented fairly, are rare. An adverse opinion suggests that a company’s financial statements are materially misstated and do not conform to generally accepted accounting principles (GAAP), a situation most companies work hard to avoid due to the severe reputational and regulatory consequences.

However, periodically, we see auditors resigning without issuing an audit opinion because of a disagreement with an accounting treatment. Arguably, these auditor resignations are a red flag because they suggest that the auditor was unable or unwilling to issue a clean audit opinion, was dismissed or resigned, and because the disagreement spilled to public disclosure.

Spectral Capital Corporation (Ticker: FCCN) disclosed in an 8-K filing dated May 7, 2025, that the Company dismissed its auditor, Michael Gillespie & Associates (MG&A), after MG&A identified numerous accounting errors that materially impacted the reliability of the Company’s 2024 quarterly financial statements and issued adverse opinions for fiscal years 2023 and 2024. Spectrum Capital engaged MG&A on May 9, 2024, following the Company’s previous auditor, BF Borgers, being sanctioned by the SEC.

Spectral Capital’s disclosure was notable because it cited a disagreement with MG&A over an accounting matter and mentioned that MG&A had issued an adverse opinion for 2024. The 2024 opinion is not publicly available as following the MG&A dismissal, Spectral Capital engaged RBSM to audit the 2024 financial report (emphasis added):

“The Company’s principal accountant’s report on the financial statements for the fiscal years ended December 31, 2024 and 2023 contained an adverse opinion. The report on the financial statements for the fiscal year ended December 31, 2023 included an explanatory paragraph relating to substantial doubt about the Company’s ability to continue as a going concern and the report on the financial statements for the fiscal year ended December 31, 2024 contained an adverse opinion related to the Accounting Matter.”

Auditor resignations that raise a red flag – management-related issues

In my previous post, I discussed why abrupt auditor resignations, accompanied by public criticism of management or a delay in hiring a replacement auditor, are a red flag.

According to Ideagen Audit Analytics' auditor changes database, three companies disclosed an auditor change, citing a disagreement with management, since January 2025.