SEC comment letters are still telling even as volume falls

How the SEC is using comment letters to press on materiality, non-GAAP metrics, and credit risk.

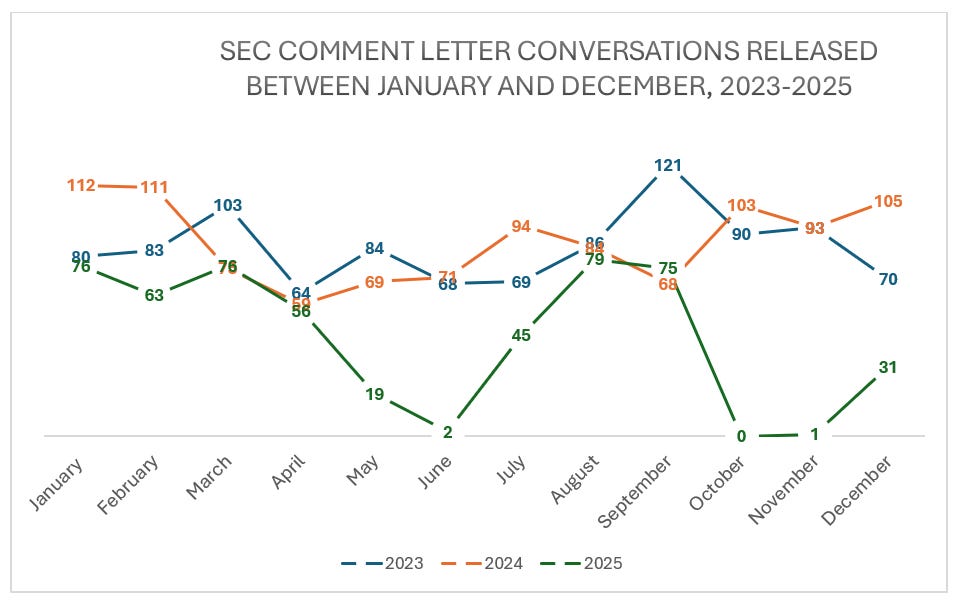

I frequently write about SEC comment letters, but over the past few quarters, I have published less on the topic simply because there has been less activity to analyze.

As shown in the updated chart below, we’ve seen a sharp decline in comment-letter conversations posted on EDGAR, which began earlier in the year and continued into the fourth quarter. October through December 2025 remained well below historical seasonal levels, reflecting not only fewer comment letters issued and cleared but also delays in releasing completed correspondence. Some of the decline may reflect fewer reviews resulting in comments or a narrower focus due to shifting Corp Fin review priorities or staffing levels. However, the continued drop in the final months of the year – with zero conversations released in October 2025 - is at least partially attributable to the SEC shutdown, which disrupted both review activity and the timing of public releases on EDGAR.

Figure 1 – SEC Comment Letters Released on EDGAR between January and December, 2023-2025

Source: Ideagen Audit Analytics Comment Letters Database, analysis by Deep Quarry.

That said, January 2026 has already produced several interesting new SEC comments worth digging into, as they supplement financial statements by providing new incremental information or by explaining why the new information was included. Note that while the comment letters discussed below were issued in 2025, they were publicly released on EDGAR in January 2026.

The distinction between disclosures added voluntarily by management and those prompted by SEC comments matters, because information disclosed only after Staff intervention reflects a judgment of materiality by the SEC - particularly noteworthy in a period of reduced comment activity.

In this piece, I discuss SEC comments to three companies:

SEC comments to Nvidia, seeking clarity on why a $4.5 billion inventory-related non-GAAP adjustment is appropriate.

SEC comments to The Bancorp Inc., seeking clarity on credit enhancement arrangements contained within third-party agreements for consumer fintech loans.

SEC comments to Goodyear Tire & Rubber Company, seeking clarity on the implications of a little r revision on internal control and procedures.

SEC Comments to Nvidia (Ticker: NVDA)

On July 22, 2025, the SEC issued comments to Nvidia, seeking clarity about why stripping a $4.5 billion inventory-related charge in non-GAAP presentation is consistent with Question 100.01 of C&DIs (emphasis added):

“We note that you disclose non-GAAP margin and non-GAAP diluted earnings per share excluding the $4.5 billion inventory charge taken in the first quarter of fiscal 2026. Please provide us more information as to the nature of the charge and explain to us why you do not believe that it represents a normal, recurring operating cost of your business. As part of your response, please tell us why you do not believe the products could be sold to another customer or have alternative use. See guidance in Question 100.01 of the SEC Staff’s Compliance and Disclosure Issues on Non-GAAP Financial Measures.”

Question 100.01 prohibits the removal of normal, recurring cash operating expenses.

“Presenting a non-GAAP performance measure that excludes normal, recurring, cash operating expenses necessary to operate a registrant’s business is one example of a measure that could be misleading.

When evaluating what is a normal, operating expense, the staff considers the nature and effect of the non-GAAP adjustment and how it relates to the company’s operations, revenue generating activities, business strategy, industry and regulatory environment.”

I previously explained why the SEC often challenges presentation of non-GAAP metrics, citing Rule 100.01:

“Importantly, unlike SEC comments that request more detailed disclosure, comments referencing Questions 100.01 or 100.04 often challenge the calculation of non-GAAP metrics. These comments can prompt companies to revise their non-GAAP accounting practices, resulting in the presentation of different—and typically lower—non-GAAP figures to investors.”

In its July 31, 2025, response, Nvidia argued that the charge was unique and unprecedented, arising directly from an April 2025 U.S. government decision to impose indefinite export-license requirements on the H20 product, rather than from operational, competitive, or technological factors.

Nvidia emphasized that H20 was purpose-built for the China market to comply with earlier export controls, has minimal alternative use outside that market, and is tied to an older Hopper architecture that is no longer in demand relative to the newer Blackwell platform:

“We respectfully advise the Staff that the H20 data center product was designed specifically for the Chinese market in conformance with specific USG license requirements, and there is not a market outside of China for H20. The manufacturing process and components for the H20 products are unique to our previous Hopper architecture and the Chinese market. Current demand from customers, not subject to an export control license, is primarily for our latest Blackwell architecture products, which has a significant improvement in performance and efficiency compared to the Hopper architecture products and H20. Outside of the China market for which the H20 products were specifically designed, there is minimal alternative use given the increased speed of NVIDIA product innovation, product releases and increased performance customers receive with the current Blackwell products.”

But you know what’s interesting? In its 10-Q filing for the quarter ending July 27, 2027, released on EDGAR on August 27, 2025, Nvidia recognized $650 million of H20 revenue because it was able to find a buyer outside China:

“In the second quarter, we recognized approximately $650 million of H20 revenue from sales to an unrestricted customer outside of China, resulting in a $180 million release of previously reserved H20 inventory. There were no H20 sales to China-based customers in the second quarter.”

In my view, NVIDIA’s subsequent partial reversal of the charge - after finding a non-China buyer for a small portion of the H20 inventory - does not alter the substance of its response to the SEC but rather underscores how fact-specific these non-GAAP determinations are.

Are Nvidia’s comments a one-off or a pattern?

The SEC’s exchange with Nvidia echoes the SEC’s earlier review of Newell Brands’ non-GAAP inventory adjustments, which illustrates how the Staff distinguishes between recurring and non-recurring, regulation-driven inventory adjustments.

In Newell’s case, the SEC initially challenged the exclusion of an inventory write-down tied to regulatory restrictions, emphasizing that lower-of-cost-or-net-realizable-value adjustments are generally part of normal operations even when triggered by external events. Newell ultimately persuaded the Staff to allow the regulatory-driven write-down to remain in non-GAAP results by demonstrating that the ban rendered the inventory unsalable, and, according to the Company, was unprecedented in scope. At the same time, Newell Brands agreed to remove inventory write-downs related to restructuring and strategic exits - costs the SEC viewed as recurring elements of the business - from future non-GAAP measures.

SEC Comments to The Bancorp Inc. (Ticker: TBBK)

On September 18, 2025, the SEC issued comments to Bancorp, seeking clarity on credit enhancement arrangements contained within third-party agreements for consumer fintech loans. Specifically, the SEC requested a more detailed disclosure of the credit enhancement agreements, including Bancorp’s role in origination and servicing, the material contractual terms and limitations of the arrangements, which fintech products are covered, and the risks associated with relying on third-party protections.